When it comes to maintaining a home, unexpected repairs can be a significant source of stress and financial strain. Fortunately, home warranty plans offer a solution by covering the costs of repairs and replacements for various home systems and appliances. In this article, we will explore the best home warranty plans available in the United States, helping you make an informed decision for your peace of mind.

What is a Home Warranty?

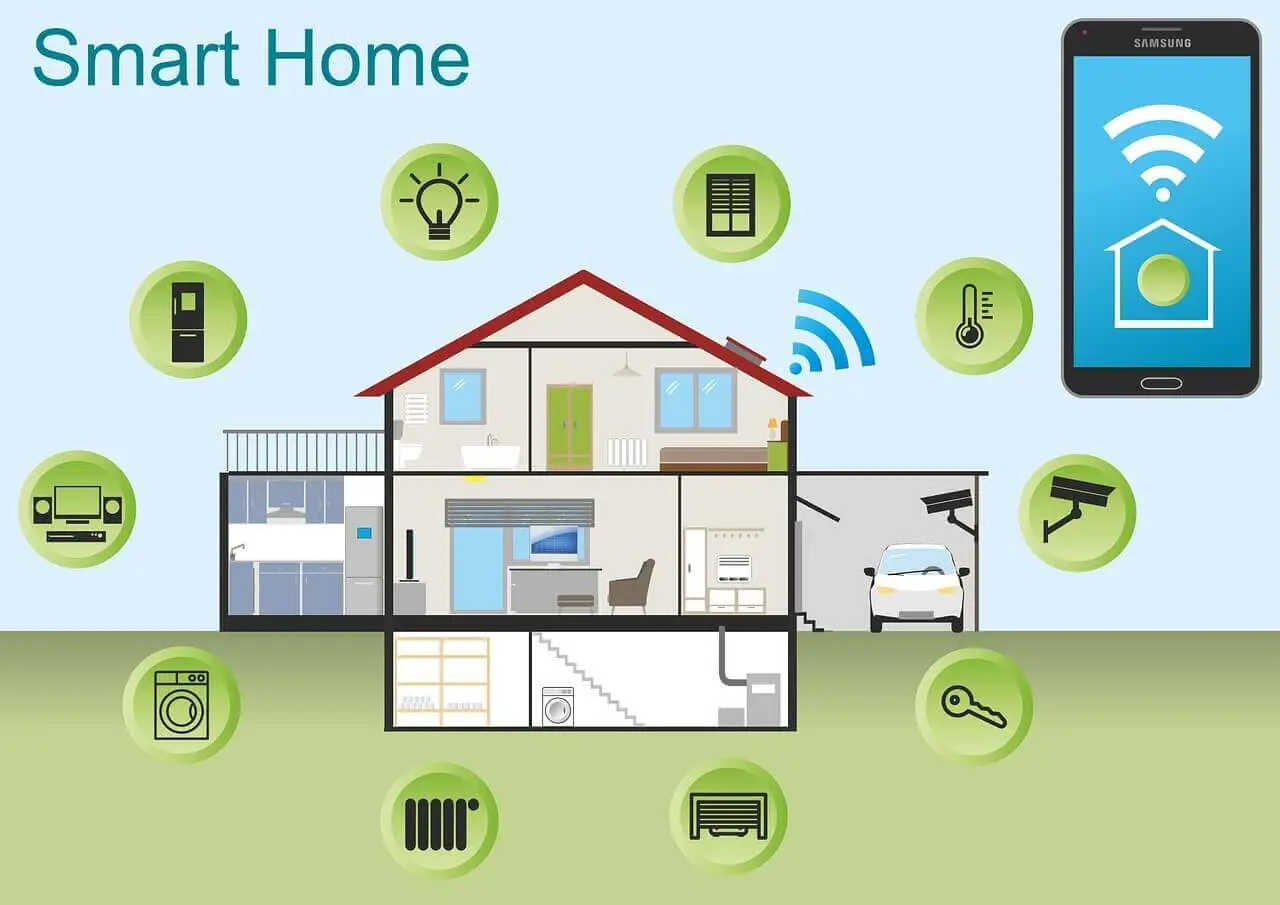

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances that break down due to normal wear and tear. Unlike homeowners insurance, which protects against damages from events like fire or theft, home warranties focus on the functionality of your home’s systems and appliances. This means that unexpected breakdowns can be handled without putting a strain on your wallet.

Top Home Warranty Companies

Below is a chart comparing some of the best home warranty plans available in the U.S. Each company offers unique coverage options, pricing, and service fees, making it easier for you to choose the right plan for your needs.

| Company | Annual Cost | Service Fee | Coverage Options |

|---|---|---|---|

| Choice Home Warranty | $1,600 | $85 | Systems, Appliances, Optional Add-ons |

| American Home Shield | $1,200 | $75-$125 | Systems, Appliances, Customizable Plans |

| First American Home Warranty | $1,000 | $75 | Systems, Appliances, Optional Coverage |

| Home Warranty of America | $1,300 | $75-$125 | Systems, Appliances, Optional Add-ons |

| Select Home Warranty | $1,200 | $75 | Systems, Appliances, Roof Coverage |

Factors to Consider When Choosing a Home Warranty

When selecting a home warranty plan, there are several factors to consider that can impact your decision:

- Coverage Options: Ensure that the plan covers the systems and appliances that are most important to you. Some plans offer optional add-ons for additional coverage, such as pools or spas.

- Cost: Compare the annual premiums and service fees. A lower annual cost may come with higher service fees, so evaluate the total cost of ownership.

- Company Reputation: Research customer reviews and ratings to gauge the reliability and responsiveness of the company. A reputable provider will have a track record of good service.

- Exclusions: Read the fine print to understand what is not covered by the warranty. Some plans may exclude specific items or conditions that could be crucial for your coverage needs.

Advantages of Home Warranty Plans

Investing in a home warranty brings several advantages:

- Budgeting: With a home warranty, you can better manage repair costs. Knowing your annual premium and service fee allows for more predictable budgeting.

- Convenience: Home warranty providers often have a network of pre-screened contractors, making it easier to find help when you need it most. This saves you the time and hassle of searching for reliable repair technicians.

- Peace of Mind: Knowing that your major appliances and systems are covered provides peace of mind, allowing you to focus on enjoying your home rather than worrying about potential breakdowns.

Conclusion

Choosing the right home warranty plan can provide you with essential coverage for repairs and peace of mind. With numerous options available in the U.S., from Choice Home Warranty to American Home Shield, it’s crucial to carefully evaluate your needs and preferences. By considering factors such as coverage options, cost, and company reputation, you can select a plan that safeguards your home and finances, ensuring that you are prepared for any unexpected repairs that may arise.