When it comes to financing your education, understanding how to navigate the student loan landscape is crucial. With the potential for overwhelming stress during this process, being informed can make a significant difference. Below, we will explore effective strategies that can help you secure a student loan with ease.

Understanding Types of Student Loans

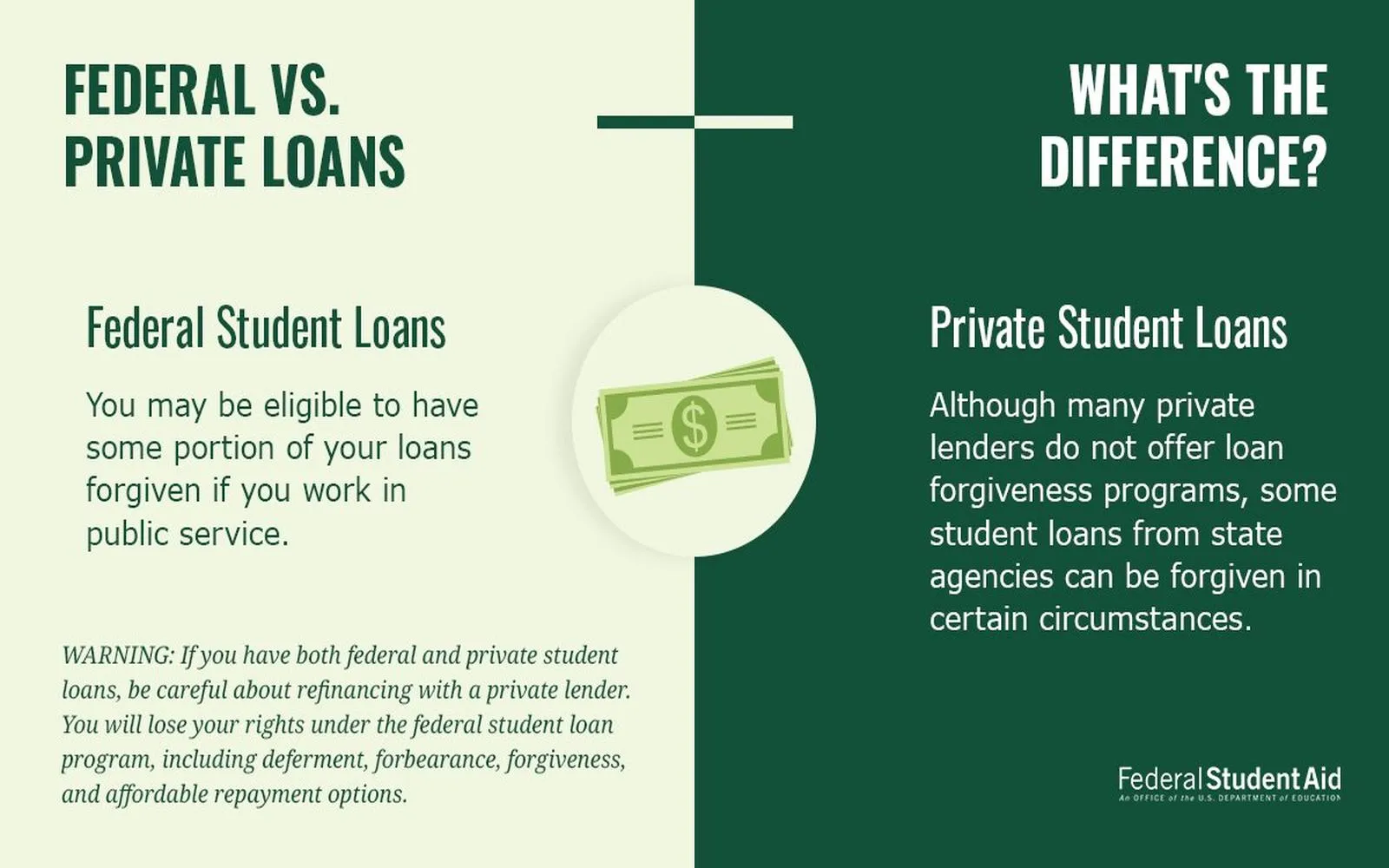

Before diving into the application process, it’s essential to understand the different types of student loans available. Broadly, they fall into two categories: federal and private loans.

- Federal Student Loans: These are offered by the government and typically come with lower interest rates and more flexible repayment options. Key federal loans include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans.

- Private Student Loans: These are provided by private lenders, such as banks and credit unions. They usually require a credit check and can have variable interest rates, making them less predictable than federal loans.

The Importance of FAFSA

The first step in securing federal student loans is completing the Free Application for Federal Student Aid (FAFSA). This form not only determines your eligibility for federal loans but also for grants and scholarships.

To ensure a smooth application process, keep these tips in mind:

- Complete your FAFSA as early as possible. Many states and colleges have deadlines that, if missed, can limit your financial aid.

- Gather necessary documents, including tax returns, bank statements, and Social Security numbers, to expedite the application process.

- Review your Student Aid Report (SAR) carefully to ensure all information is accurate.

Choosing the Right Loan

Once you’ve completed your FAFSA and received your financial aid award letter, it’s time to evaluate your options. Here’s a quick comparison of federal and private loans:

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Interest Rates | Fixed and lower | Variable or fixed, often higher |

| Repayment Options | Flexible, including income-driven plans | Varies by lender |

| Credit Check | No credit check for most | Typically requires good credit |

| Loan Forgiveness | Available | Not available |

Reducing Stress During Application

Applying for student loans can be daunting, but with the right strategies, you can minimize stress:

- Research Lenders: If considering private loans, evaluate multiple lenders to find the best terms. Use comparison tools to weigh interest rates, fees, and repayment options.

- Understand Your Budget: Calculate how much you need to borrow and your potential monthly payments post-graduation. This can help you avoid borrowing more than you can afford to repay.

- Seek Guidance: Don’t hesitate to reach out to your school’s financial aid office for assistance. They can provide insights tailored to your specific situation.

Managing Your Loan After Approval

After securing your loan, the next step is effectively managing it. Here are some tips to keep your loan stress-free:

- Stay Organized: Keep all loan documents in one place. This includes loan agreements, payment schedules, and correspondence from your lender.

- Set Up Automatic Payments: Many lenders offer discounts for borrowers who set up automatic payments. This can help you avoid late fees and streamline your repayment process.

- Explore Repayment Plans: Familiarize yourself with various repayment options. Federal loans offer income-driven repayment plans that can ease financial burdens based on your income.

Conclusion

With thorough research and careful planning, obtaining a student loan doesn’t have to be a stressful experience. By understanding the types of loans, completing the FAFSA, and managing your loan effectively, you can focus more on your education and less on financial worries. Remember, reaching out for help and utilizing available resources can significantly ease the process. The goal is to secure the funds you need while minimizing stress, allowing you to thrive academically.