In today's digital age, opening a free online business bank account is a straightforward process that can greatly benefit entrepreneurs and small business owners. Whether you're just starting out or looking to streamline your existing finances, here are some easy steps to help you open your account without any hassle.

Step 1: Research Your Options

The first step in opening a free online business bank account is to research various banks and credit unions. Not all financial institutions offer the same features, so it’s crucial to compare their services. Look for accounts that provide free transactions, no monthly fees, and convenient online banking options. Some popular choices include:

| Bank/Credit Union | Monthly Fee | Transaction Limit |

|---|---|---|

| Chase Business Complete Banking | $0 (with qualifying activities) | Unlimited electronic transactions |

| Bank of America Business Fundamentals | $16 (waived with $250 balance) | 200 free transactions |

| BlueVine Business Checking | $0 | Unlimited transactions |

| NBKC Business Account | $0 | Unlimited transactions |

As you compare options, pay attention to features such as mobile banking, ATM access, and integrations with accounting software. This will help you select the best fit for your business needs.

Step 2: Gather Required Documentation

Once you've chosen a bank, the next step is to gather all necessary documentation. Typically, you'll need the following:

- Employer Identification Number (EIN): This is essential for tax purposes and is required for most business types.

- Business License: Some banks may ask for proof that your business is legally registered.

- Operating Agreement: If you're part of an LLC or partnership, having an operating agreement can be beneficial.

- Personal Identification: A government-issued ID, like a driver's license or passport, is usually required.

Having all these documents ready will expedite the application process and ensure a smoother experience.

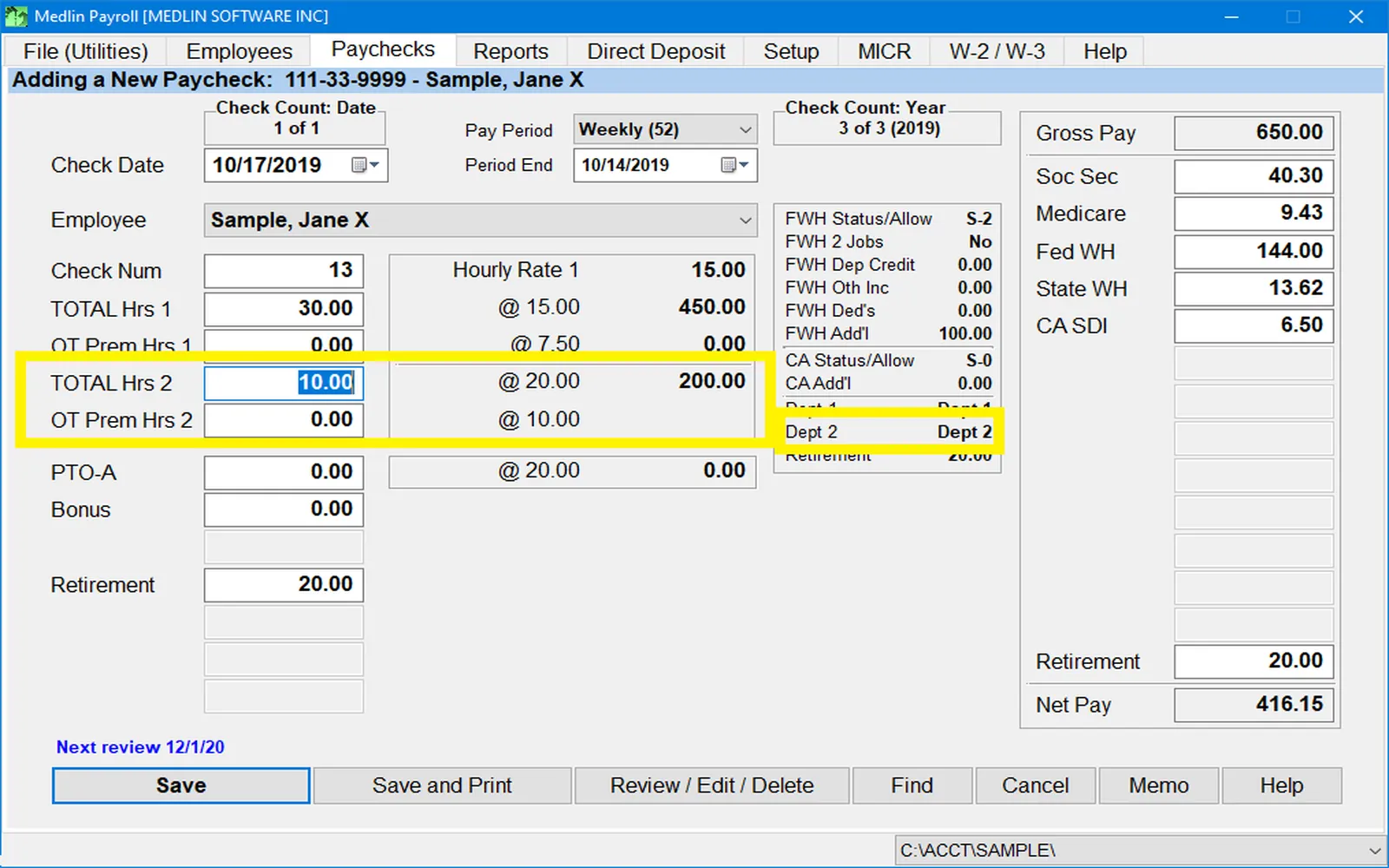

Step 3: Complete the Application Process

Now that you have your documents in order, you can proceed to complete the application process. Most banks offer a user-friendly online application that can be completed in just a few minutes. Here’s what to expect:

- Visit the bank’s website and navigate to the business banking section.

- Select the free business checking account option.

- Fill out the application form with your business details, including your business name and address.

- Upload or provide the required documentation for verification.

- Review and submit your application.

After submission, the bank will review your application. This may take a few minutes to a few days, depending on the institution.

Step 4: Fund Your Account

After your application is approved, you will need to fund your account. Most banks require an initial deposit to activate your account. This amount varies from bank to bank, but many online banks offer no minimum deposit for free accounts. You can typically fund your account via:

- Electronic transfer from another bank account

- Direct deposit from your employer or clients

- Check deposit via mobile app

Ensure you understand the funding options available and choose the one that works best for you.

Step 5: Set Up Online Banking Features

Once your account is funded, take advantage of the bank’s online features. Set up online banking, which allows you to manage your finances conveniently. This may include:

- Setting up alerts for transactions and balances

- Linking your account with accounting software like QuickBooks or FreshBooks

- Enabling mobile access for banking on the go

These features can help you stay organized and track your business finances efficiently.

Step 6: Monitor Your Account Regularly

After successfully opening your free online business bank account, it’s essential to monitor your account regularly. Regularly check for any unauthorized transactions and ensure that your balance aligns with your accounting records. Set reminders for any fees or charges that might apply and keep an eye on your transaction limits to avoid any unexpected costs.

Conclusion

Opening a free online business bank account doesn’t have to be a daunting task. By following these easy steps—researching your options, gathering documentation, completing the application, funding your account, setting up online features, and monitoring your account—you can enjoy the benefits of efficient banking for your business. With the right account, you can manage your finances more effectively and focus on growing your business.