In recent years, the financial landscape has witnessed a significant evolution with the advent of robo-advisors. These automated investment platforms have simplified the investment process, making it accessible for individuals with varying levels of financial literacy. Understanding how robo-advisors work, their advantages, and their limitations can empower you to make informed decisions about your investment strategy.

What Are Robo-Advisors?

Robo-advisors are online platforms that provide automated financial planning services with little to no human supervision. They utilize algorithms and software to manage your investment portfolio based on your financial goals, risk tolerance, and time horizon. Typically, users complete a questionnaire to help the platform assess their financial situation and investment preferences. Based on this information, the robo-advisor allocates assets in a diversified portfolio, often comprised of low-cost index funds and exchange-traded funds (ETFs).

How Robo-Advisors Work

The process of investing with a robo-advisor is straightforward:

- Initial Assessment: After signing up, users complete a risk assessment questionnaire that evaluates their financial goals, investment timeline, and risk tolerance.

- Portfolio Construction: Based on the gathered data, the robo-advisor constructs a personalized investment portfolio that aligns with the user’s objectives.

- Automatic Rebalancing: Over time, as market conditions change, the robo-advisor will automatically rebalance the portfolio to maintain the desired asset allocation.

- Tax Optimization: Many robo-advisors offer tax-loss harvesting, a strategy that helps minimize tax liabilities by offsetting capital gains with losses.

Benefits of Using Robo-Advisors

Choosing a robo-advisor comes with several advantages:

- Cost-Effective: Robo-advisors typically charge lower fees compared to traditional financial advisors, making them a budget-friendly option for many investors.

- Accessibility: With a low minimum investment requirement, robo-advisors are accessible to a broader audience, including novice investors.

- Time-Saving: Automation allows investors to set their portfolios and let the algorithm handle the rest, freeing up time for other activities.

- Diversification: Robo-advisors create diversified portfolios, which can reduce risk compared to investing in individual stocks.

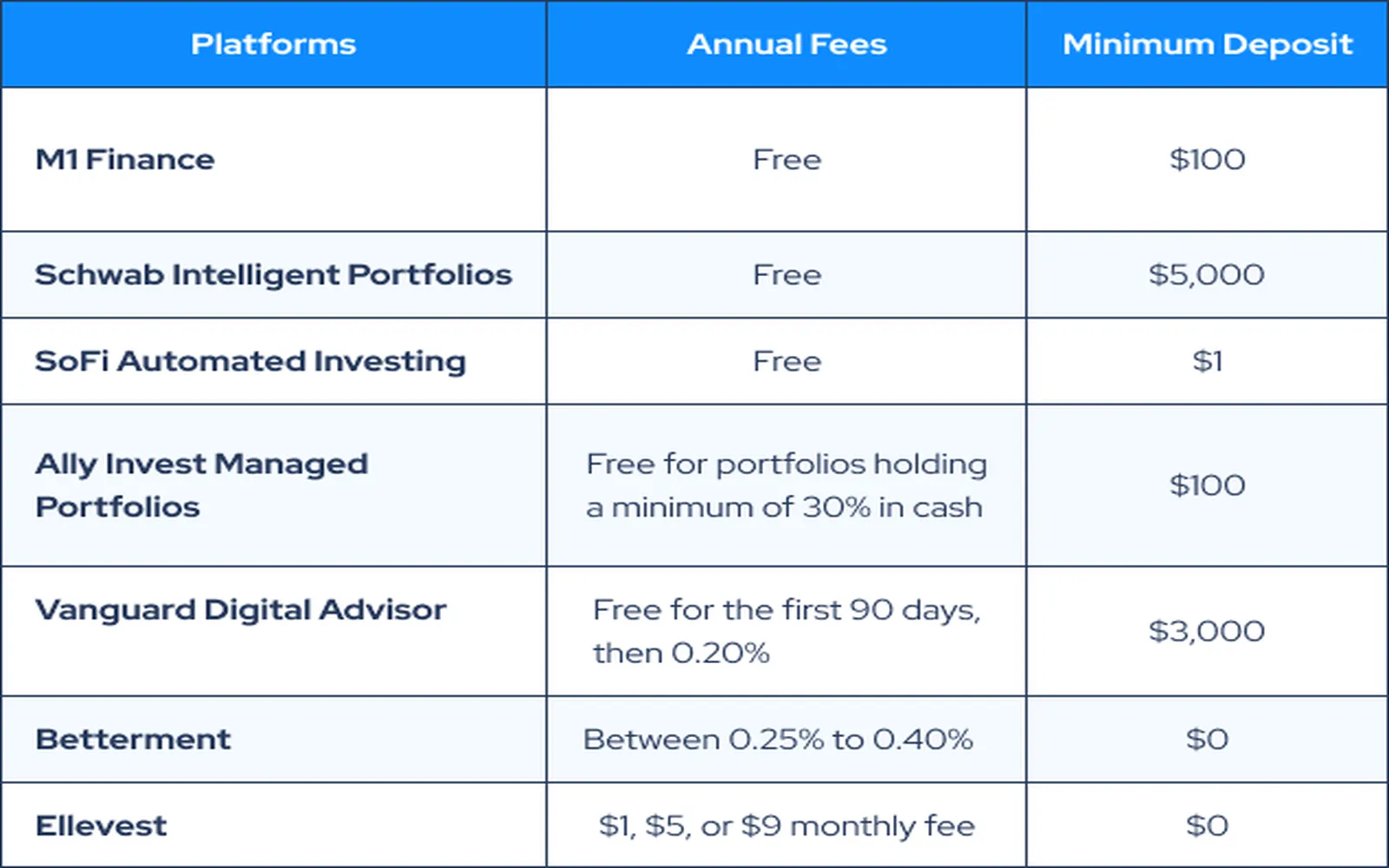

Chart: Robo-Advisor Comparison

Below is a comparison chart of some popular robo-advisors available in the United States, showcasing their fees and features:

| Robo-Advisor | Management Fee | Minimum Investment | Tax-Loss Harvesting |

|---|---|---|---|

| Betterment | 0.25% | $0 | Yes |

| Wealthfront | 0.25% | $500 | Yes |

| Ellevest | 0.25% - 0.50% | $0 | Yes |

| SoFi Invest | 0% | $1 | No |

Limitations of Robo-Advisors

While robo-advisors offer numerous benefits, they also have some limitations:

- Lack of Personalization: Although robo-advisors provide tailored portfolios based on algorithms, they may lack the personal touch of human financial advisors who can consider nuances in individual situations.

- Limited Investment Choices: Many robo-advisors restrict investments to a predetermined selection of funds, which may not align with every investor's preferences.

- Market Volatility: Robo-advisors can’t predict market downturns, and automated systems may not react as swiftly as a human advisor could in times of crisis.

Conclusion

Robo-advisors represent a transformative shift in the investment world, making investing more accessible and affordable for the average American. By providing automated, algorithm-driven investment management, they allow individuals to invest wisely without the need for extensive financial knowledge. However, it’s essential to weigh the benefits against the limitations and decide whether a robo-advisor aligns with your financial goals. As you consider your investment options, remember that while robo-advisors can simplify the process, they should be part of a broader strategy that includes a thorough understanding of your financial objectives.