What is Robo-Investing?

Robo-investing refers to the use of automated platforms that manage your investments using algorithms. These platforms usually require minimal human intervention and are designed to provide passive growth through diversified portfolios. They typically assess your risk tolerance and investment goals to create a customized investment strategy, making it easier for users to invest without needing extensive financial knowledge. As a result, robo-investing has gained popularity among both novice and experienced investors looking to maximize their returns with minimal effort.

Benefits of Using Robo-Investing Platforms

Choosing a robo-investing platform offers several advantages, including:

- Low Fees: Most robo-advisors charge lower fees than traditional financial advisors, making investing more accessible.

- Ease of Use: With user-friendly interfaces and straightforward sign-up processes, these platforms are designed for everyone, including those who are new to investing.

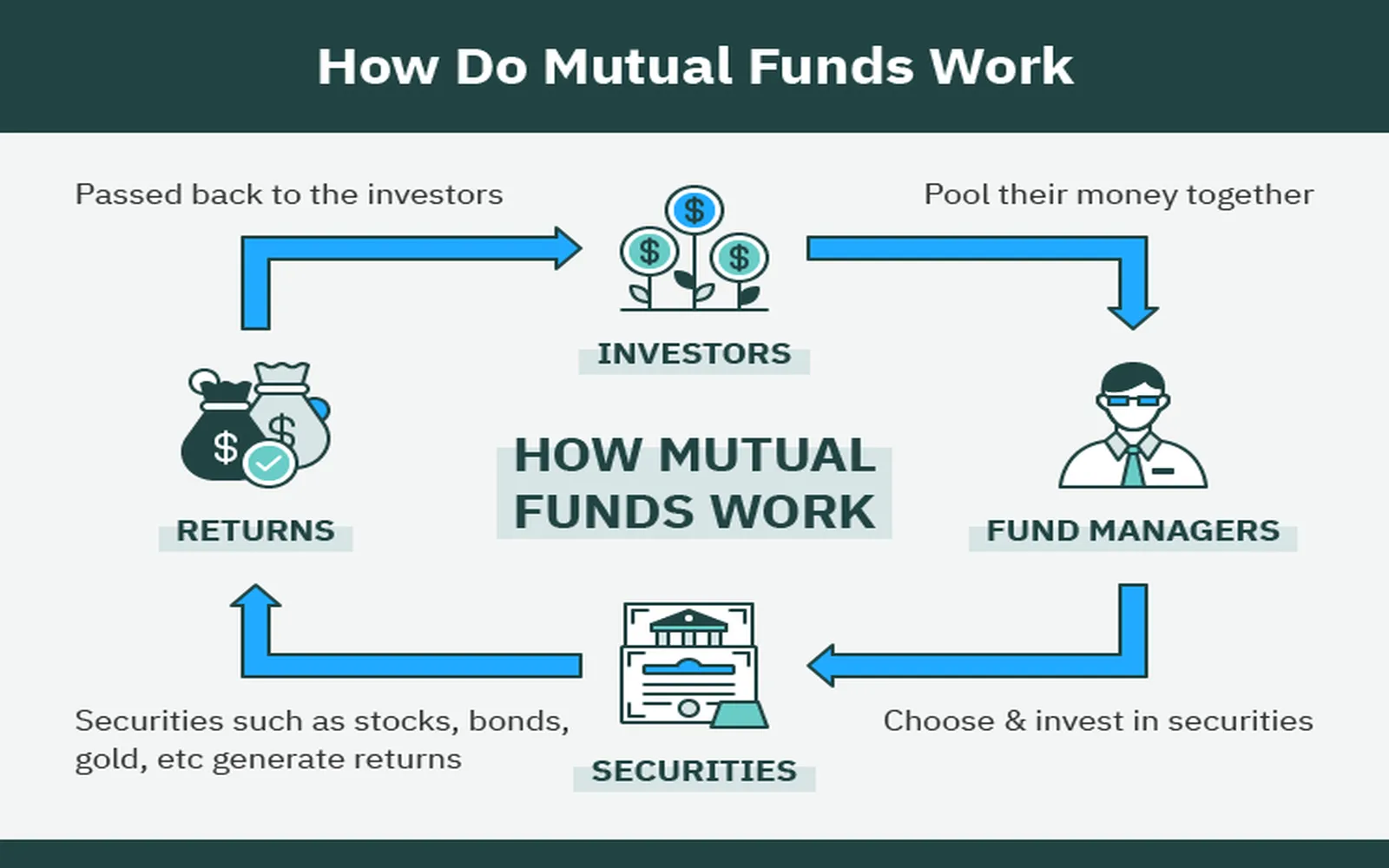

- Diversification: Robo-investors typically allocate your funds across a variety of assets, reducing risk and enhancing potential returns.

- Automatic Rebalancing: Many platforms automatically adjust your portfolio to maintain your desired asset allocation.

Top Robo-Investing Platforms for Passive Growth

Here’s a look at some of the leading robo-investing platforms available in the United States that can help you achieve passive growth:

| Platform | Minimum Investment | Fees | Features |

|---|---|---|---|

| Betterment | $10 | 0.25% annually | Tax-loss harvesting, automatic rebalancing, financial planning tools |

| Wealthfront | $500 | 0.25% annually | Tax-loss harvesting, financial planning, and investment management |

| Acorns | $5 | $1/month (for accounts under $1M) | Round-up investments, diversified portfolios, educational resources |

| SoFi Invest | $1 | 0% management fees | No commissions, automatic rebalancing, crypto investment options |

| M1 Finance | $100 | 0% management fees | Custom portfolios, automatic rebalancing, fractional shares |

1. Betterment

Betterment is one of the pioneers in the robo-advising industry. With a low minimum investment of just $10, it is accessible to a wide range of investors. Betterment charges an annual fee of 0.25%, which covers account management and features like tax-loss harvesting and automatic rebalancing. Their user-friendly app also offers financial planning tools, making it easier to track your investment goals.

2. Wealthfront

Wealthfront is another highly regarded platform, requiring a minimum investment of $500. Similar to Betterment, it charges a 0.25% annual fee. Wealthfront offers automated tax-loss harvesting, which can significantly enhance your returns by offsetting capital gains taxes. The platform's financial planning tools help users set and achieve their financial goals effectively.

3. Acorns

Acorns stands out by allowing users to invest spare change. With a minimum investment of just $5, Acorns rounds up your everyday purchases to the nearest dollar and invests the difference. It charges a flat fee of $1 per month for accounts under $1 million, making it an affordable option for new investors. Acorns also provides a variety of educational resources to help users learn more about investing.

4. SoFi Invest

SoFi Invest has become popular due to its zero management fees and low minimum investment of just $1. This platform offers automatic rebalancing and even allows users to invest in cryptocurrencies. With no commission on trades, SoFi Invest is an excellent option for those looking to diversify their investments without incurring high costs.

5. M1 Finance

M1 Finance allows investors to create customized portfolios with a minimum investment of $100. It features zero management fees and offers automatic rebalancing as well. With M1 Finance, you can invest in fractional shares, which means you can diversify your portfolio without needing substantial capital.

Conclusion

Selecting the right robo-investing platform is crucial for achieving your passive growth goals. With options like Betterment, Wealthfront, Acorns, SoFi Invest, and M1 Finance, investors in the United States have access to a variety of features, fees, and investment strategies to suit their needs. By leveraging these platforms, you can pave the way for a more secure financial future without the stress of active management.