Understanding Online Investing Platforms

In the digital age, investing has become more accessible than ever. With the rise of technology, numerous online platforms have emerged, allowing users to invest smartly and efficiently. This article highlights the best online platforms for smarter investing available to investors in the United States.

Factors to Consider When Choosing an Investing Platform

Before diving into the best platforms, it’s important to consider a few key factors:

- Fees: Look for platforms with transparent pricing structures. Some charge commissions, while others offer commission-free trading.

- Investment Options: Ensure the platform provides access to a diverse range of investment vehicles like stocks, ETFs, mutual funds, and cryptocurrencies.

- User Experience: A user-friendly interface can significantly enhance your investing experience.

- Research Tools: Quality platforms provide analytical tools and educational resources to help users make informed decisions.

- Customer Support: Reliable customer service is crucial for addressing any inquiries or issues that may arise.

Top Online Platforms for Smarter Investing

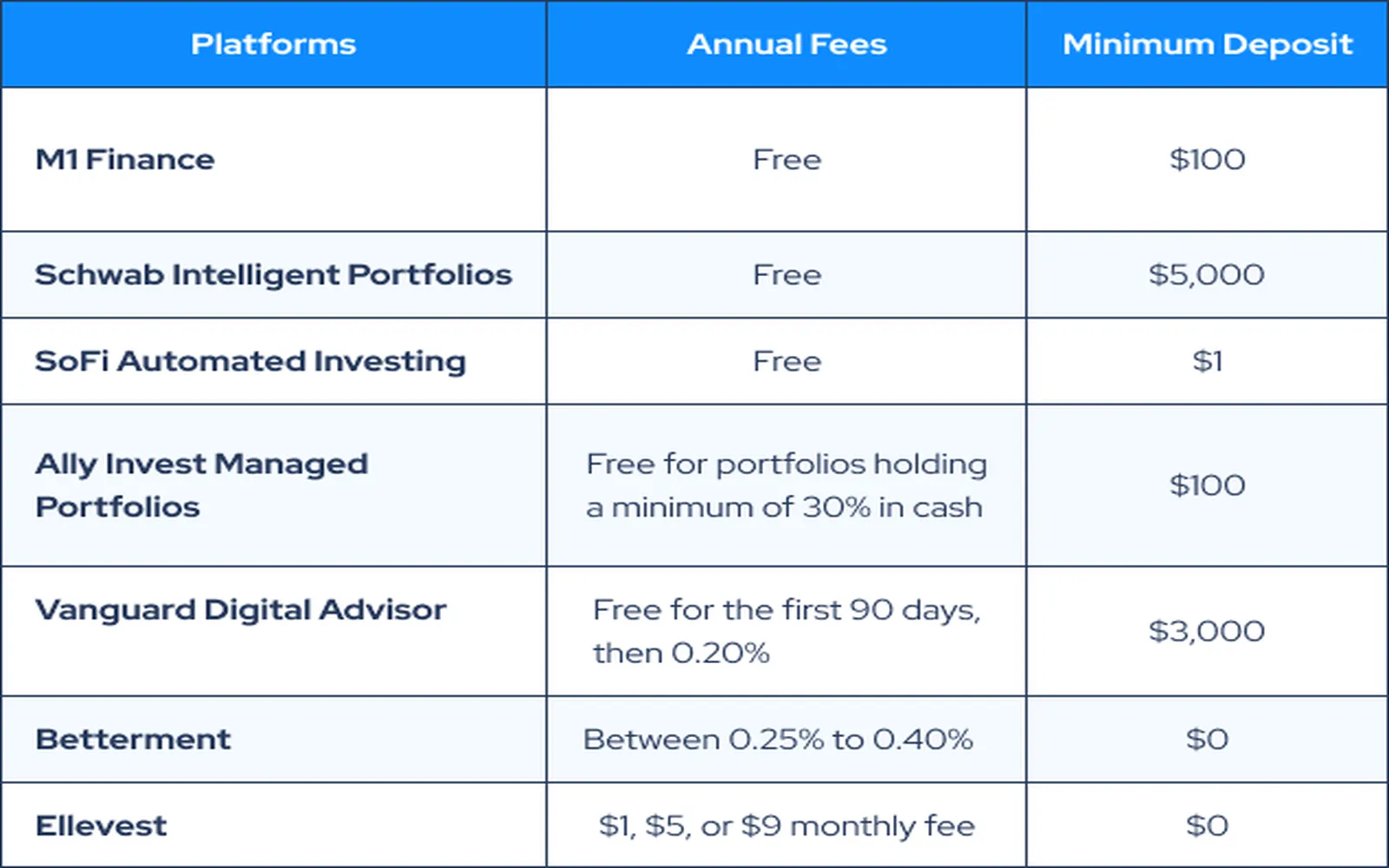

Here’s a comparison of some of the leading online investing platforms available in the U.S.:

| Platform | Fees | Investment Options | Features | User Rating |

|---|---|---|---|---|

| Robinhood | Commission-free | Stocks, ETFs, Options, Cryptos | Easy-to-use app, Cash Management | 4.5/5 |

| E*TRADE | $0 commissions | Stocks, ETFs, Mutual Funds, Bonds | Power E*TRADE platform, Research tools | 4.7/5 |

| Fidelity | $0 commissions | Stocks, ETFs, Mutual Funds, Options | Extensive research, Educational resources | 4.8/5 |

| TD Ameritrade | $0 commissions | Stocks, ETFs, Options, Futures | Thinkorswim platform, Research tools | 4.6/5 |

| Webull | Commission-free | Stocks, ETFs, Options | Advanced charting, Community features | 4.4/5 |

1. Robinhood

Robinhood revolutionized the investment landscape by introducing commission-free trading. The platform is extremely user-friendly, making it ideal for beginners. With access to stocks, ETFs, options, and cryptocurrencies, Robinhood allows users to manage their investments through a mobile app that features a clean and simple design. However, it’s worth noting that while Robinhood offers ease of use, it may lack some in-depth research tools compared to its competitors.

2. E*TRADE

E*TRADE is another excellent choice for both beginners and experienced investors. With $0 commissions on stocks and ETFs, it provides a robust trading platform with advanced features. Its Power E*TRADE platform offers sophisticated charting tools, which are beneficial for technical analysis. E*TRADE also provides a wealth of research and educational resources, making it a solid choice for those looking to improve their investing knowledge.

3. Fidelity

Fidelity is well-regarded for its comprehensive range of investment options and exceptional customer service. With no commissions on trades, Fidelity offers a highly-rated platform with extensive research and analysis tools. Moreover, its educational resources cater to investors at all levels, making it easier to develop effective investment strategies. Fidelity’s commitment to customer satisfaction has earned it a strong reputation among investors.

4. TD Ameritrade

TD Ameritrade is often praised for its powerful trading platform, Thinkorswim, which is ideal for active traders and those who prefer a more hands-on approach. Like the other platforms mentioned, TD Ameritrade offers $0 commissions on trades. The platform is rich in educational tools and research materials, providing users with valuable insights and data to make informed investment decisions.

5. Webull

Webull is a newer platform that has gained popularity for its commission-free trading and advanced features. It offers a comprehensive suite of analytical tools and real-time market data, making it suitable for more experienced investors. Additionally, Webull’s community features allow users to engage with other investors, share insights, and learn from one another. Its mobile app is designed for convenience, making investing on the go a breeze.

Conclusion

Choosing the right online investing platform depends on your individual needs, investment goals, and level of experience. The platforms mentioned in this article are among the best for smarter investing, providing various features and tools to help you navigate the investment landscape effectively. Whether you’re a beginner or an experienced investor, these platforms can enhance your investment journey and lead you towards achieving your financial goals.