In today’s fast-paced financial landscape, the need for effective and efficient fund management tools has never been more critical. As investors seek to maximize returns while minimizing risks, the evolution of technology has birthed a new generation of smarter fund management tools. These tools not only streamline the investment process but also provide insights that empower investors to make informed decisions.

Understanding Fund Management Tools

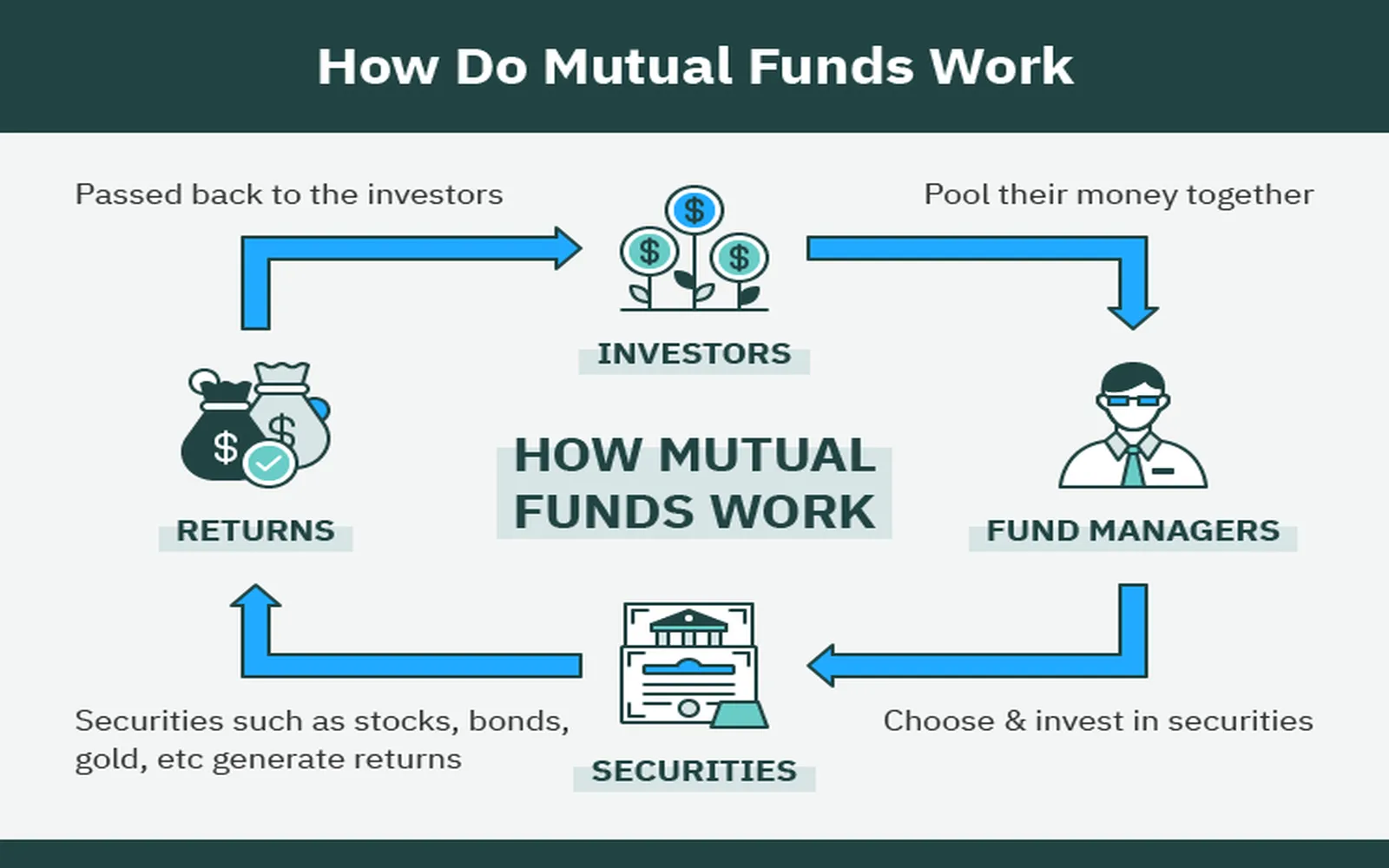

Fund management tools are software applications designed to help investors and fund managers track, analyze, and optimize their investment portfolios. They can range from simple tracking applications to complex platforms incorporating advanced analytics and artificial intelligence (AI). The primary goal of these tools is to enhance the decision-making process, ultimately leading to better returns on investments.

Key Features of Smarter Fund Management Tools

Modern fund management tools are equipped with several features that set them apart from traditional methods. Here are some of the most valuable features:

- Real-time Data Analysis: Smarter tools provide real-time data that allows investors to react swiftly to market changes. This feature is crucial for capturing opportunities and minimizing losses.

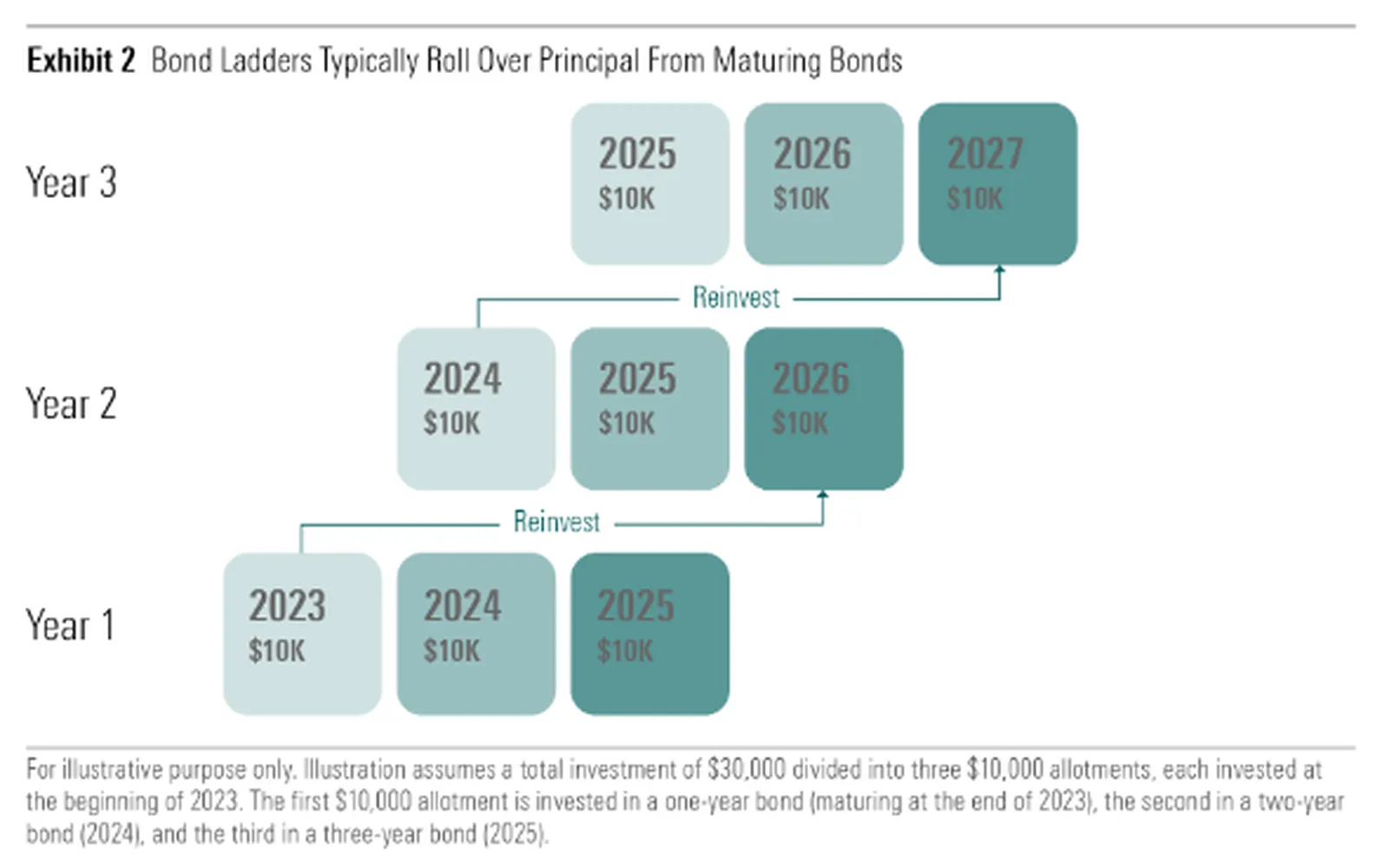

- Automated Portfolio Rebalancing: Many platforms offer automated rebalancing, ensuring that portfolios remain aligned with the investor’s goals and risk tolerance over time.

- Advanced Analytics: Incorporating AI and machine learning, these tools can analyze vast amounts of data to identify trends, forecast market movements, and suggest optimal investment strategies.

- Risk Assessment: Smarter fund management tools offer comprehensive risk assessment features, helping investors understand potential risks associated with their portfolios.

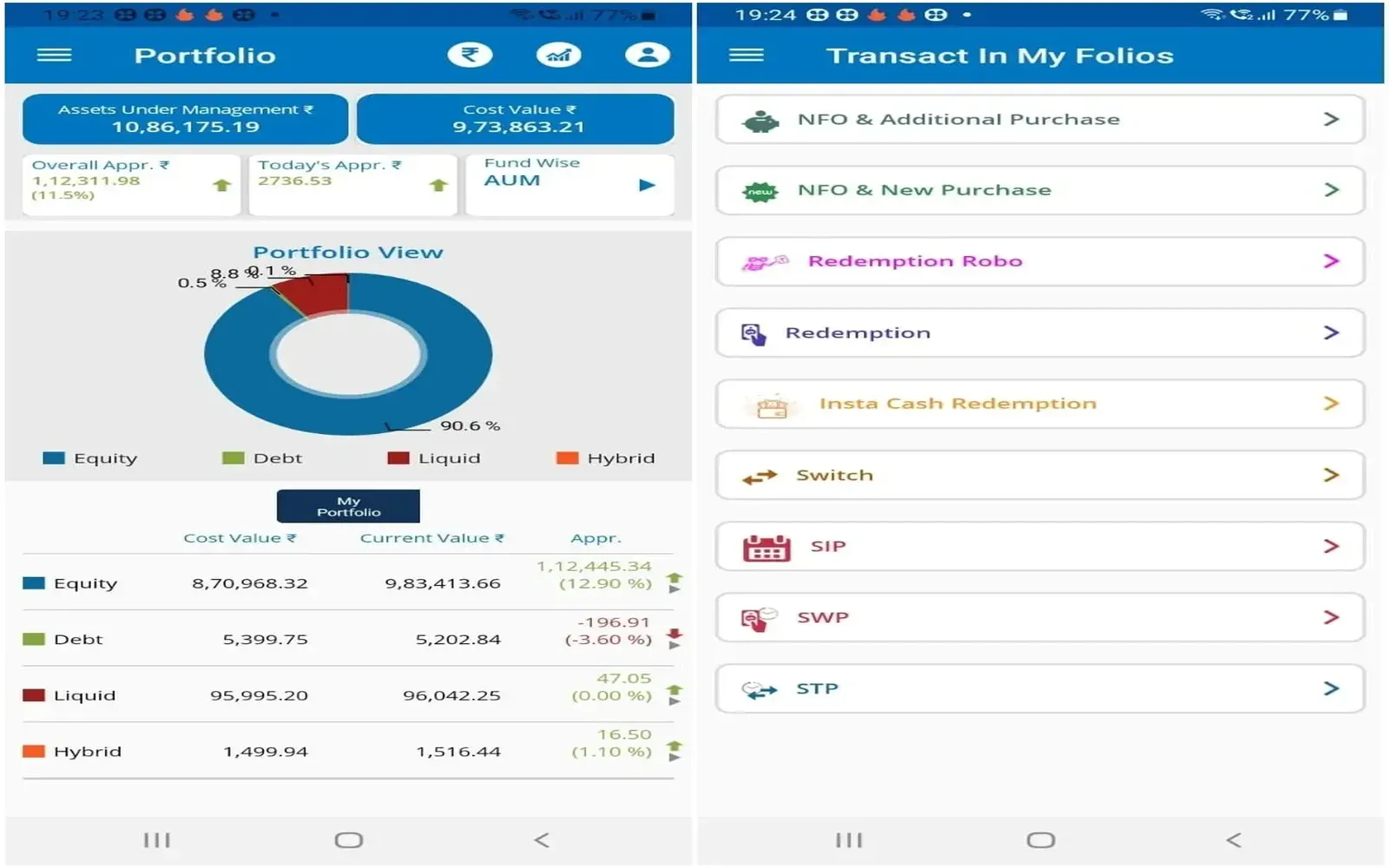

- User-friendly Interfaces: Enhanced UX/UI design makes these tools more accessible, allowing users to navigate through complex data easily.

Benefits of Using Smarter Fund Management Tools

Investors who leverage these advanced tools can enjoy a range of benefits, including:

- Increased Efficiency: Automation of routine tasks allows fund managers to focus on strategy and decision-making rather than data entry and monitoring.

- Improved Decision Making: With access to real-time data and advanced analytics, investors can make timely and informed decisions that align with their financial goals.

- Cost-effectiveness: Many smarter fund management tools reduce the need for expensive financial advisors, making sophisticated investment strategies accessible to a broader audience.

- Enhanced Transparency: Investors can easily track their investments, understand performance, and make adjustments as needed, leading to greater confidence in their investment choices.

Choosing the Right Fund Management Tool

When selecting a fund management tool, consider the following factors:

- Integration Capabilities: Ensure that the tool can integrate with your existing platforms and data sources for seamless operation.

- Cost Structure: Evaluate the pricing model—some tools charge monthly fees, while others may take a percentage of your assets under management.

- User Support: Look for tools that offer excellent customer support, including tutorials and resources to help you maximize the tool’s capabilities.

- Scalability: Choose a tool that can grow with your investment needs, whether you’re managing a small portfolio or a multi-million dollar fund.

Chart: Comparison of Popular Fund Management Tools

Below is a comparison chart of several popular fund management tools, highlighting their key features:

| Tool Name | Real-time Data | Automated Rebalancing | Advanced Analytics | Cost |

|---|---|---|---|---|

| Tool A | Yes | Yes | Yes | $20/month |

| Tool B | Yes | No | Yes | Free |

| Tool C | No | Yes | No | $15/month |

| Tool D | Yes | Yes | Yes | $30/month |

Conclusion

The landscape of fund management is evolving, and investing in smarter fund management tools is essential for those looking to optimize their investment strategies. By leveraging these advanced tools, investors can enhance their decision-making capabilities, increase efficiency, and ultimately achieve better returns. As the financial world continues to change, staying ahead with the right technology will be key to successful investing.