As the demand for socially responsible investment options continues to rise, ethical investing has become a significant trend among American investors. With a growing awareness of environmental, social, and governance (ESG) factors, many are looking for ways to align their portfolios with their values. In this article, we will explore the concept of ethical investing and highlight some of the best ESG funds to watch in 2023.

What is Ethical Investing?

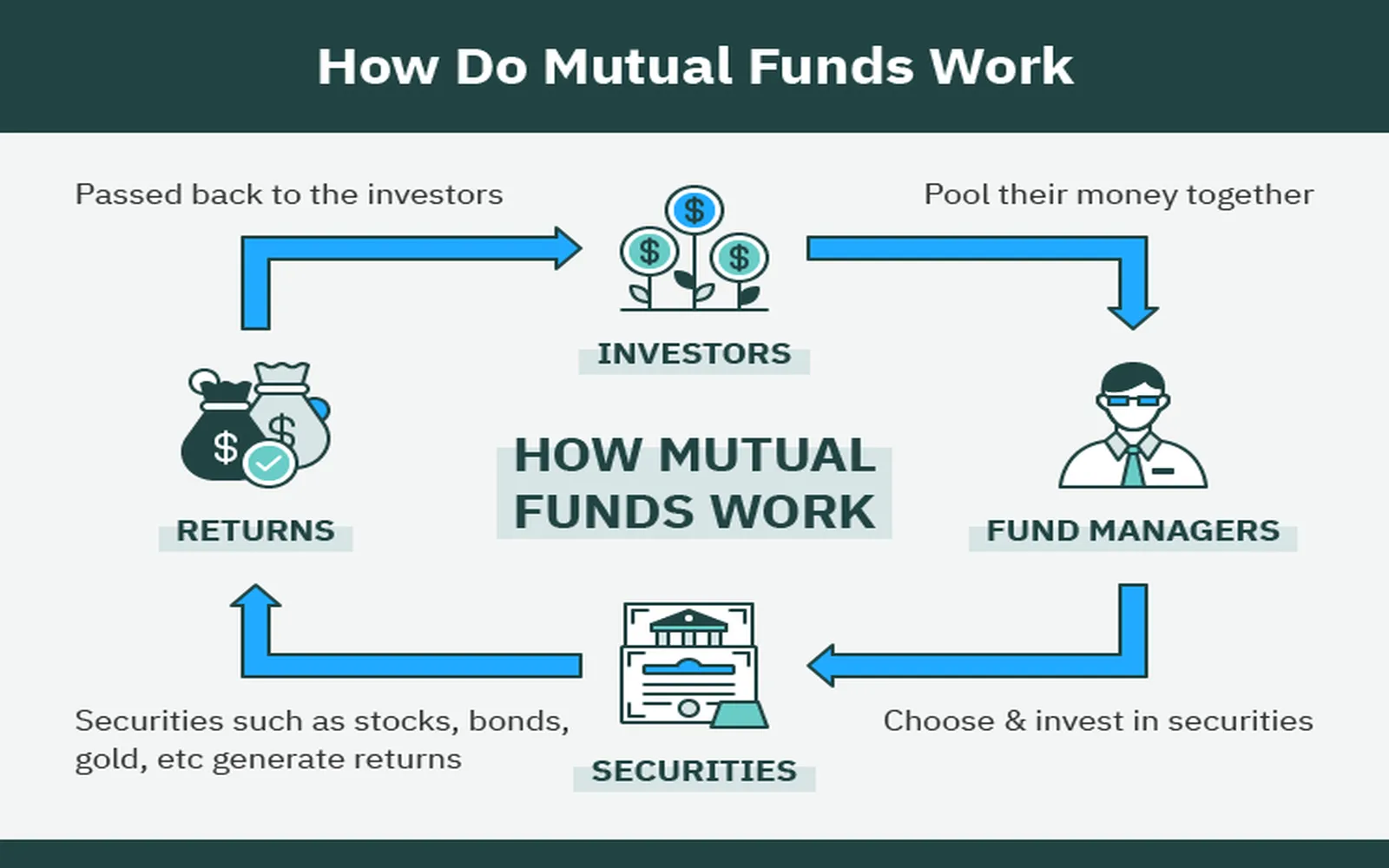

Ethical investing refers to the practice of selecting investments based on ethical guidelines or standards. Investors often seek to support companies that demonstrate a commitment to sustainability, social justice, and ethical governance. This approach not only aims to generate financial returns but also seeks to make a positive impact on society and the environment.

Understanding ESG Criteria

ESG criteria are a set of standards used to evaluate a company’s operations and performance in three key areas:

- Environmental: This criterion examines how a company performs as a steward of nature. It includes factors such as carbon emissions, waste management, and resource conservation.

- Social: This aspect focuses on a company’s relationships with its stakeholders, including employees, customers, and the communities in which it operates. It encompasses labor practices, diversity, and community engagement.

- Governance: This criterion assesses a company’s leadership, executive pay, audits, and shareholder rights. It emphasizes transparency and ethical operations.

Investors can use these criteria to screen potential investments, ensuring that their portfolios reflect their values and contribute to a sustainable future.

Top ESG Funds to Watch in 2023

With a wide array of ESG funds available, choosing the right one can be overwhelming. Below is a chart featuring some of the best ESG funds to consider in 2023, based on performance, management, and commitment to ethical investing:

| Fund Name | Type | Expense Ratio | 3-Year Annualized Return |

|---|---|---|---|

| Vanguard FTSE Social Index Fund (VFTSX) | Index Fund | 0.14% | 14.52% |

| iShares MSCI KLD 400 Social ETF (DSI) | ETF | 0.25% | 13.89% |

| SPYG - SPDR Portfolio S&P 500 Growth ETF | ETF | 0.04% | 13.25% |

| TIAA-CREF Social Choice Equity Fund (TICRX) | Mutual Fund | 0.50% | 12.78% |

| Fidelity U.S. Sustainability Index Fund (FSSTX) | Index Fund | 0.035% | 14.20% |

These funds not only exhibit strong financial performance but also align with ethical investing principles, focusing on companies that prioritize ESG factors.

Why Invest in ESG Funds?

Investing in ESG funds offers several advantages:

- Positive Impact: By investing in companies with strong ESG practices, you contribute to a more sustainable and equitable world.

- Risk Management: Companies with robust ESG practices often face lower risks related to regulatory penalties and reputational damage, making them more resilient in the long run.

- Attractive Returns: Numerous studies have shown that ESG funds can perform on par with or even outperform traditional investments, offering competitive returns.

Factors to Consider When Choosing ESG Funds

When selecting an ESG fund, keep these factors in mind:

- Fund Strategy: Understand the fund’s investment strategy and how it integrates ESG factors into its decision-making process.

- Management Team: Research the fund’s management team and their experience in both investing and ESG issues.

- Performance History: Review the fund’s historical performance to ensure it meets your investment goals.

- Expense Ratios: Compare the expense ratios of different funds, as lower fees can significantly enhance your returns over time.

Conclusion

As the world moves towards greater sustainability and social responsibility, ethical investing through ESG funds is likely to grow in popularity. By investing in these funds, you not only aim for financial returns but also contribute to a better future. Whether you are a seasoned investor or just starting, consider incorporating ESG funds into your portfolio to align your investments with your values. Keep an eye on the funds mentioned above as they continue to lead the way in the ethical investing landscape.