Exchange-Traded Funds, or ETFs, have gained immense popularity among investors looking for a way to grow their wealth over time. For beginners, understanding how to invest in ETFs can seem daunting, but with the right information, you can start your journey toward long-term growth with confidence. This guide will help you navigate the world of ETF investing and provide essential tips to ensure your success.

What are ETFs?

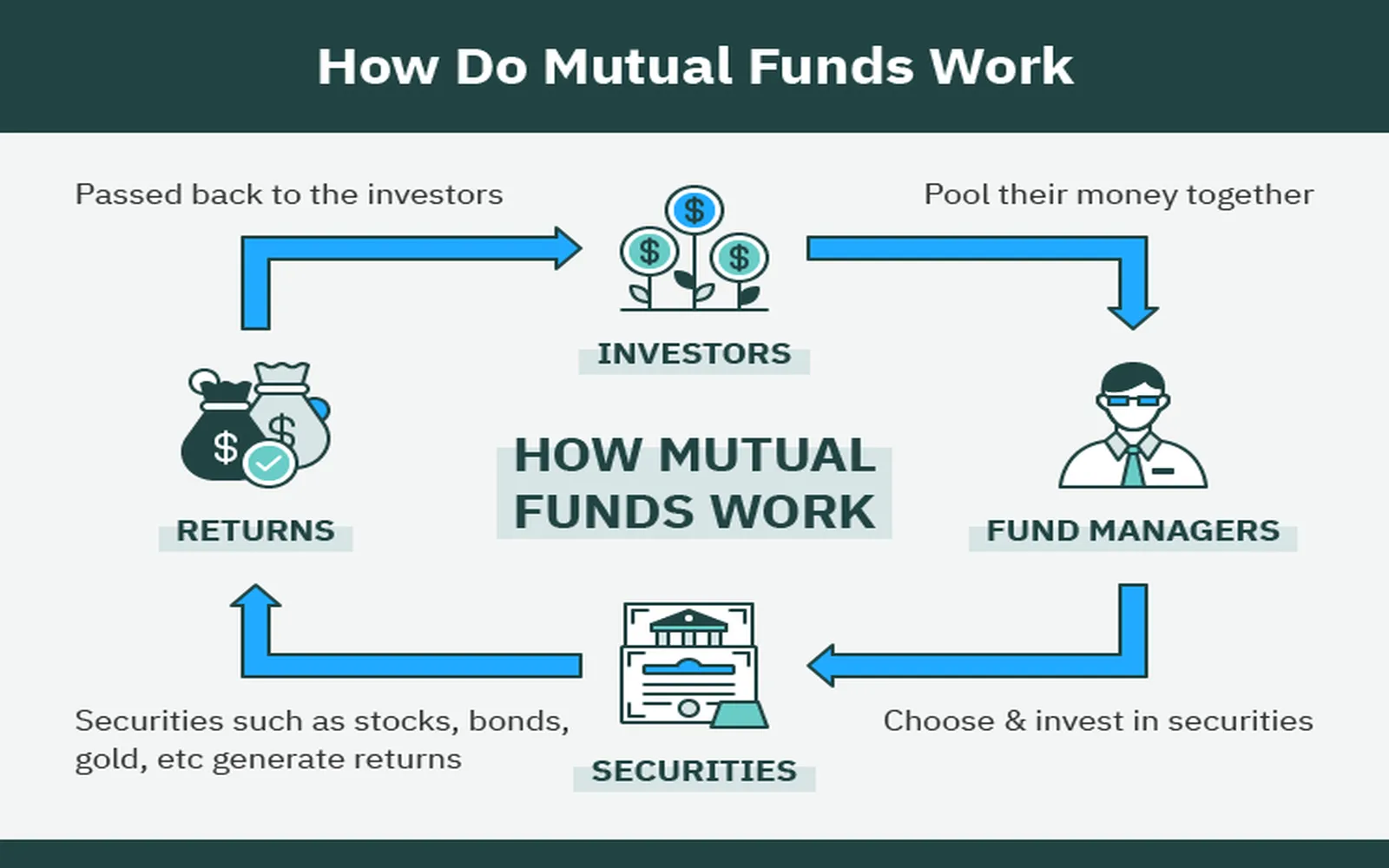

ETFs are investment funds that trade on stock exchanges, much like individual stocks. They hold a collection of assets, which can include stocks, bonds, commodities, or a mix of various investments. One of the key benefits of ETFs is their ability to provide instant diversification, as they typically contain multiple securities within a single fund. This diversification helps reduce risk while still offering the potential for growth.

Why Invest in ETFs?

There are several compelling reasons to consider ETF investing for long-term growth:

- Cost-Effective: ETFs generally have lower expense ratios compared to mutual funds. This means you keep more of your investment returns over time.

- Tax Efficiency: ETFs tend to be more tax-efficient than mutual funds, meaning you may pay fewer capital gains taxes.

- Liquidity: Since ETFs trade on major exchanges, you can buy and sell them throughout the trading day, giving you flexibility in your investment strategy.

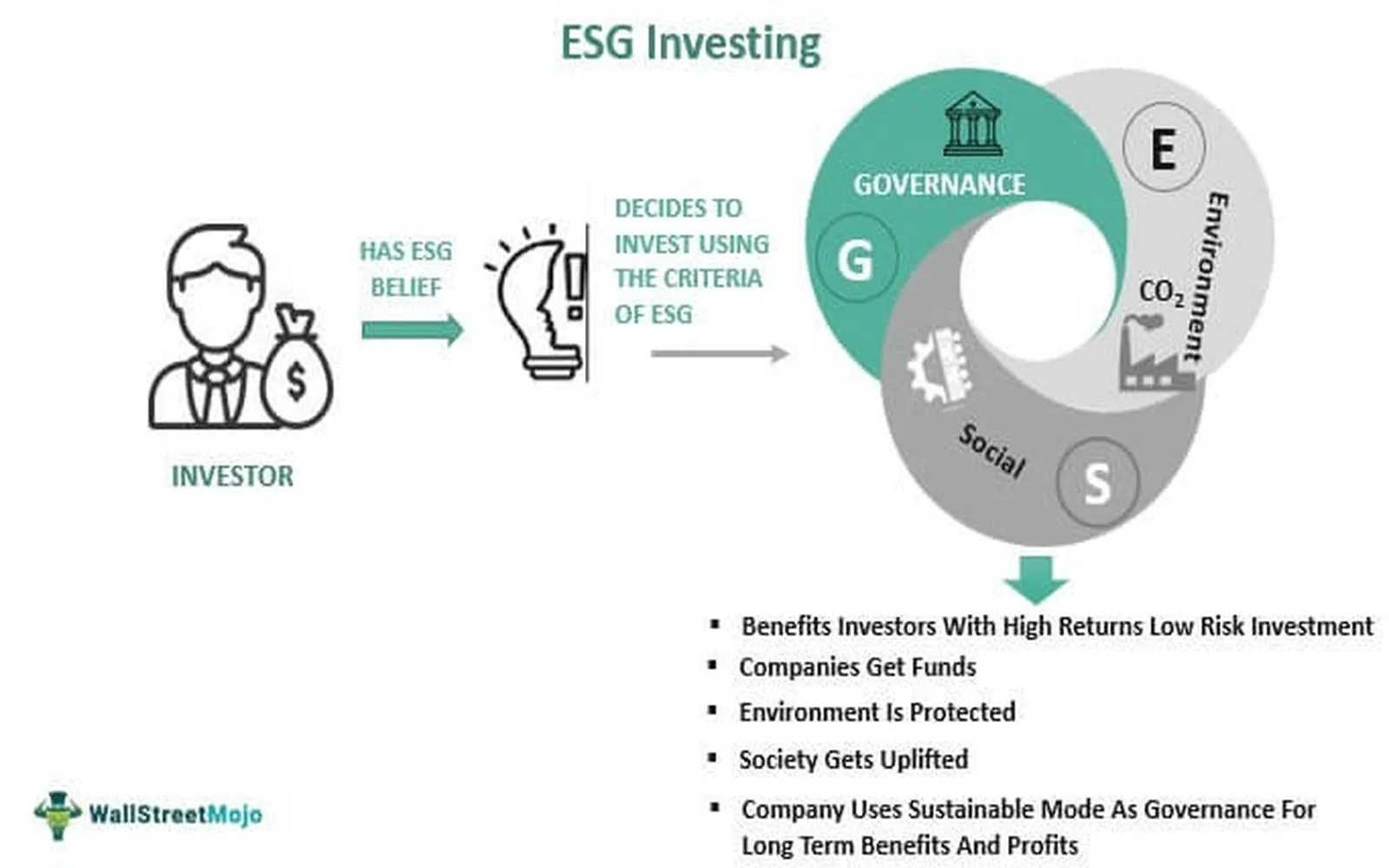

- Diverse Options: With thousands of ETFs available, you can find funds that track specific sectors, regions, or investment strategies that align with your financial goals.

How to Get Started with ETF Investing

Starting your journey with ETF investing involves a few key steps:

1. Educate Yourself

Before diving in, it’s crucial to familiarize yourself with basic investment terminology and concepts. Understand how ETFs work, the different types available, and the risks involved. Resources like investment blogs, podcasts, and online courses can be helpful.

2. Set Financial Goals

Clearly define your financial goals. Are you saving for retirement, a major purchase, or simply looking to grow your wealth? Having specific objectives will help you choose the right ETFs for your portfolio.

3. Choose a Brokerage Account

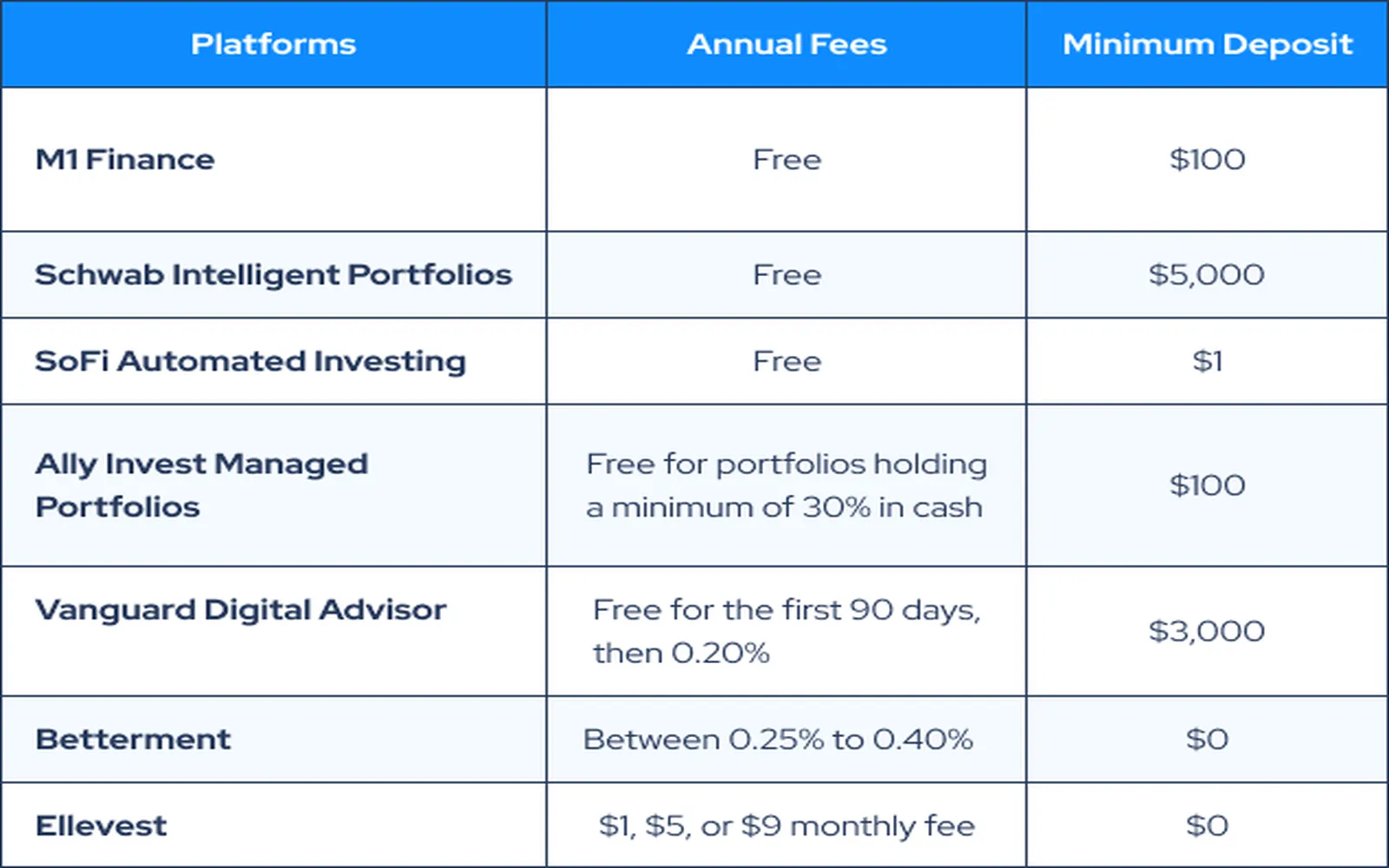

To buy and sell ETFs, you’ll need a brokerage account. Look for a platform that offers low trading fees, user-friendly interfaces, and educational resources. Many brokerages also allow you to invest in ETFs without commissions, which can further reduce your costs.

4. Understand ETF Types

There are several types of ETFs to consider:

- Stock ETFs: These track specific indices or sectors. For example, an S&P 500 ETF invests in the top 500 U.S. companies.

- Bond ETFs: These focus on fixed-income securities and can provide income through dividends.

- Sector and Industry ETFs: These target specific sectors like technology, healthcare, or energy.

- International ETFs: These invest in foreign markets, providing exposure to global economies.

Building Your ETF Portfolio

Once you have a brokerage account and understand the types of ETFs available, you can start building your portfolio. Here are some tips:

1. Diversify

While ETFs themselves provide diversification, it’s essential to ensure your entire portfolio is well balanced. Consider including a mix of stock and bond ETFs, as well as funds that track different sectors and regions.

2. Dollar-Cost Averaging

To mitigate the risks associated with market volatility, consider using a strategy called dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of the ETF's price. Over time, this strategy can lower your average cost per share.

3. Monitor Your Investments

Regularly review your ETF portfolio to ensure it aligns with your financial goals. While long-term investing is key, market conditions and personal circumstances can change, so staying informed is crucial.

Chart: ETF Growth Over Time

Here’s a simple chart illustrating the growth of a hypothetical ETF investment over a 10-year period, assuming an annual return of 7%:

| Year | Investment Value |

|---|---|

| 0 | $10,000 |

| 1 | $10,700 |

| 2 | $11,449 |

| 3 | $12,250 |

| 4 | $13,103 |

| 5 | $13,999 |

| 6 | $14,939 |

| 7 | $15,925 |

| 8 | $16,959 |

| 9 | $18,042 |

| 10 | $19,175 |

Conclusion

Investing in ETFs can be a powerful way to achieve long-term growth. By understanding the fundamentals, setting clear goals, and building a diversified portfolio, you can position yourself for financial success. Remember that investing is a marathon, not a sprint—patience and diligence will pay off over time. With the knowledge gained from this guide, you’re ready to embark on your ETF investing journey.