In today’s volatile market, investing globally can be an effective strategy for diversifying your portfolio and reducing risk. However, it requires careful planning and knowledge of various factors that can impact your investments. Here are some essential global investment tips to help you minimize portfolio risk while maximizing your potential returns.

1. Diversify Across Geographies

Diversification is a fundamental principle of investing. By spreading your investments across different countries and regions, you can mitigate the risk associated with any single economy. For instance, if the U.S. market is underperforming, investments in emerging markets or developed economies could offset losses. Consider allocating a percentage of your portfolio to regions like Europe, Asia, or Latin America to enhance your diversification.

2. Invest in Various Asset Classes

Another way to reduce portfolio risk is by investing in multiple asset classes, such as stocks, bonds, real estate, and commodities. Each asset class reacts differently to market conditions; for example, when equities are down, bonds may perform better. A well-balanced portfolio that includes various asset classes can help cushion against losses and provide more stable returns over time.

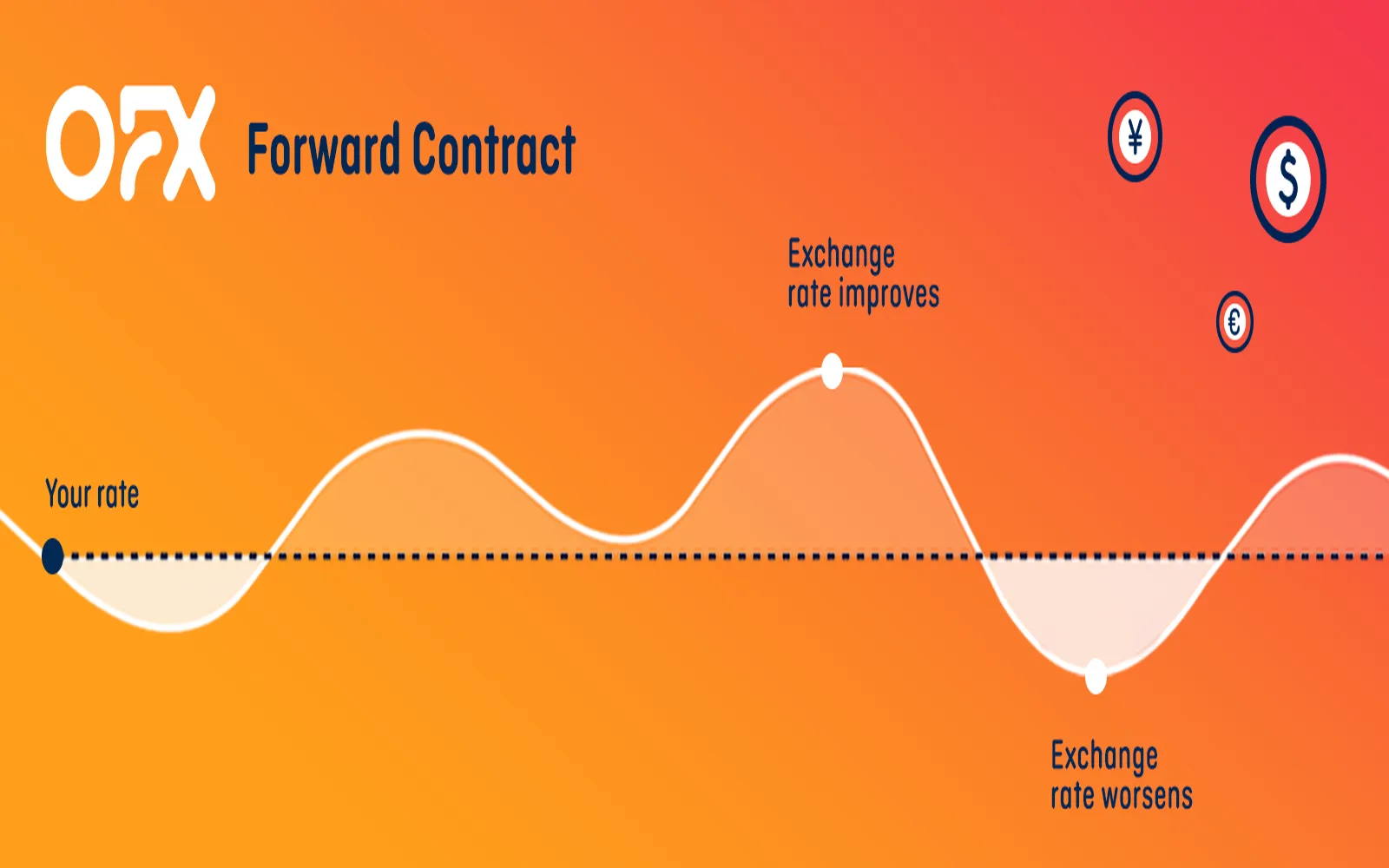

3. Consider Currency Risk

When investing globally, be aware of currency risk. Fluctuations in exchange rates can significantly impact your investment returns. To mitigate this risk, consider investing in assets denominated in the local currency of the country you are investing in. Additionally, you can use currency hedging strategies, such as forward contracts or options, to protect against adverse currency movements.

4. Research Political and Economic Stability

Understanding the political and economic climate of the countries you are investing in is crucial. Countries with stable governments and robust economies tend to have less risk associated with their markets. Keep an eye on factors such as GDP growth, inflation rates, and political stability. Use resources like the World Bank and International Monetary Fund for up-to-date information on different countries.

5. Monitor Global Economic Indicators

Stay informed about global economic indicators, such as interest rates, employment figures, and trade balances. These indicators can provide insights into the health of economies and help you make informed investment decisions. For example, rising interest rates in the U.S. may lead to capital outflows from emerging markets, potentially impacting your global investments.

6. Use Exchange-Traded Funds (ETFs)

ETFs can be an excellent way to gain exposure to international markets while reducing risk. They typically offer lower fees than mutual funds and provide instant diversification across a wide range of securities. Look for ETFs that track global indices or specific regions to easily diversify your investments and reduce risk.

7. Regularly Rebalance Your Portfolio

Over time, certain investments may outperform others, leading to an unbalanced portfolio. Regularly rebalancing your portfolio ensures that your asset allocation stays aligned with your risk tolerance and investment goals. This process involves selling assets that have increased in value and buying those that have decreased, which can help maintain your desired level of risk.

8. Seek Professional Advice

If you're unsure about how to navigate global markets, consider seeking advice from financial professionals. Financial advisors can provide tailored strategies to fit your financial goals, risk tolerance, and market conditions. They can also help you stay informed about global trends and make strategic adjustments to your portfolio as needed.

9. Stay Informed and Educated

Investing globally requires ongoing education. Stay updated on market trends, economic forecasts, and geopolitical events that could impact your investments. Subscribe to financial news outlets, attend investment seminars, and read books on global investing to enhance your knowledge and make better-informed decisions.

Global Investment Tips Summary

Investing globally can provide significant opportunities for growth while also presenting unique challenges. By following these global investment tips, you can effectively reduce portfolio risk and enhance your potential returns. Remember to diversify across geographies and asset classes, monitor economic indicators, and stay informed about political climates. With careful planning and continuous education, you can navigate the complexities of global investing successfully.

Sample Asset Allocation Chart

Below is a sample asset allocation chart designed to help you visualize how to diversify your portfolio across different asset classes and geographies:

| Asset Class | Percentage Allocation |

|---|---|

| U.S. Stocks | 30% |

| International Stocks | 20% |

| Emerging Market Stocks | 15% |

| U.S. Bonds | 20% |

| International Bonds | 10% |

| Real Estate | 5% |

By implementing these strategies and maintaining a well-diversified portfolio, you can enhance your global investment approach and reduce overall risk, paving the way for long-term financial success.