Managing an investment portfolio can be a daunting task, especially for those who are new to the world of investing. Fortunately, there are numerous digital tools available that can help streamline the process, making it easier to track performance, analyze trends, and make informed decisions. Below, we explore some of the best digital tools for managing your investment portfolio.

1. Personal Capital

Personal Capital is a comprehensive financial management tool that allows users to track their investments, net worth, and expenses all in one place. It provides a clear overview of your investment portfolio, including asset allocation and performance tracking. With its intuitive dashboard, Personal Capital helps users identify areas where they can optimize their investment strategies.

One of the standout features of Personal Capital is its free financial tools, which include a Retirement Planner and an Investment Checkup tool. These tools help users assess whether they are on track to meet their financial goals.

2. Morningstar Premium

Morningstar is renowned for its in-depth analysis of stocks, mutual funds, and ETFs. With a Premium subscription, investors gain access to advanced research tools, investment insights, and portfolio management features. Morningstar’s star rating system is particularly useful for evaluating the performance of various investment options.

Furthermore, its Portfolio X-Ray tool provides users with a detailed breakdown of their holdings, including sector exposure and risk analysis, making it easier to manage and rebalance your portfolio.

3. Robinhood

Robinhood is a popular trading platform that offers commission-free trading for stocks, ETFs, options, and cryptocurrencies. Its user-friendly interface is designed for both beginners and experienced investors. Robinhood allows users to manage their investment portfolio seamlessly, providing real-time data and easy access to market trends.

In addition, Robinhood's robinhood gold feature offers advanced tools like margin trading and larger instant deposits, enhancing the investment experience for active traders.

4. Mint

Mint is primarily known as a budgeting tool, but it can also be used to track investment portfolios. By linking your investment accounts, Mint allows you to see your overall financial picture in one place. It provides insights into your spending habits and helps you understand how your investments fit into your broader financial goals.

The platform includes features for tracking your net worth, monitoring expenses, and setting financial goals, making it a versatile tool for personal finance management.

5. Yahoo Finance

Yahoo Finance is a reliable source for real-time stock market data, news, and analysis. It allows users to create customizable watchlists and track their investment portfolios with ease. Users can receive alerts on stock price changes and access comprehensive financial news, which is essential for making informed investment decisions.

Additionally, Yahoo Finance offers interactive charts and historical data analysis, helping investors evaluate trends and forecast potential market movements.

6. eToro

eToro is a social trading platform that not only allows users to trade stocks and cryptocurrencies but also offers a unique feature called CopyTrading. This allows investors to copy the trades of experienced investors, making it an excellent tool for beginners who want to learn from successful traders.

The platform also provides a comprehensive portfolio management tool that allows users to track the performance of their investments and access detailed analytics, helping them make better investment decisions.

7. Wealthfront

Wealthfront is a robo-advisor that simplifies the investment process by automatically managing your portfolio based on your risk tolerance and financial goals. It offers tax-loss harvesting and financial planning tools, making it an excellent choice for those who prefer a hands-off approach to investing.

Wealthfront's user-friendly interface allows investors to monitor their portfolio’s performance and adjust their investment strategies as needed, ensuring they stay on track toward their financial goals.

8. Chart Comparison

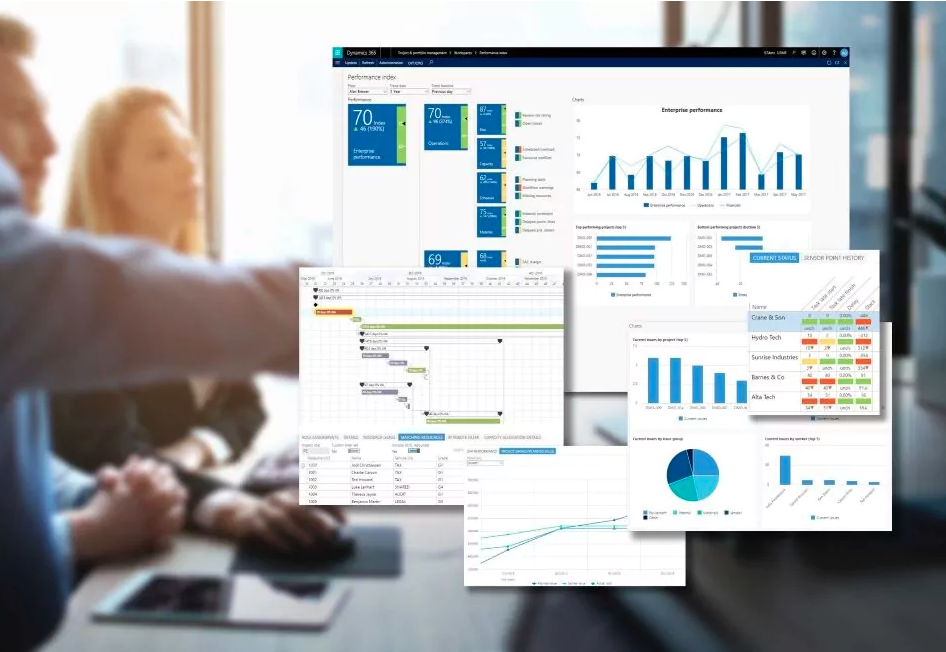

To help you visualize the strengths of these digital tools, here's a comparison chart:

| Tool | Key Features | Best For |

|---|---|---|

| Personal Capital | Financial planning, investment tracking | Holistic financial management |

| Morningstar Premium | In-depth investment research | Detailed stock and fund analysis |

| Robinhood | Commission-free trading | Active trading |

| Mint | Budgeting and expense tracking | Personal finance management |

| Yahoo Finance | Real-time market data | Market analysis |

| eToro | Social trading, CopyTrading | Learning from experienced traders |

| Wealthfront | Automated investment management | Hands-off investing |

Conclusion

Choosing the right digital tools for managing your investment portfolio can significantly enhance your investment experience. Whether you're looking for comprehensive financial management, in-depth analysis, or a user-friendly trading platform, there’s a tool suited to your needs. By leveraging these tools, investors can make informed decisions, track performance, and ultimately achieve their financial goals with greater confidence.