When it comes to building a balanced investment portfolio, incorporating commodities can provide both diversification and a hedge against inflation. Adding these tangible assets can be especially beneficial in times of economic uncertainty. Below, we explore some of the best commodity investments to consider for a well-rounded portfolio.

Why Invest in Commodities?

Investing in commodities can offer several advantages. These assets often move independently of stock and bond markets, which helps reduce overall portfolio risk. Additionally, commodities tend to perform well during periods of inflation, making them a reliable choice for preserving purchasing power. Here are some key reasons to consider:

- Diversification: Commodities can help spread risk across different asset classes.

- Inflation Hedge: Commodities typically increase in value as the cost of living rises.

- Global Demand: Many commodities, such as oil and agricultural products, are in constant demand worldwide, making them relatively stable investments.

Top Commodity Investments

Here is a look at some of the most promising commodity investments that can enhance your portfolio’s balance:

1. Gold

Gold has long been viewed as a safe haven in times of economic turmoil. Its value tends to rise when stock markets decline, making it an excellent hedge against market volatility. Investors can buy physical gold, gold ETFs, or mining stocks to gain exposure to this precious metal.

2. Silver

Similar to gold, silver is also considered a safe-haven asset. However, it has industrial applications, which can contribute to its price fluctuations. Investing in silver can be done through physical bullion, ETFs, or mining stocks, providing multiple avenues for exposure.

3. Crude Oil

Crude oil is one of the most actively traded commodities in the world. Its prices are influenced by geopolitical factors, supply and demand dynamics, and economic indicators. Investing in oil can be accomplished through futures contracts, ETFs, or shares of oil companies.

4. Agricultural Commodities

Agricultural commodities like corn, wheat, and soybeans can provide a unique investment opportunity. These commodities are essential for food production and are influenced by seasonal cycles and climate conditions. Investing in agricultural commodities can be done through futures, ETFs, or farmland investments.

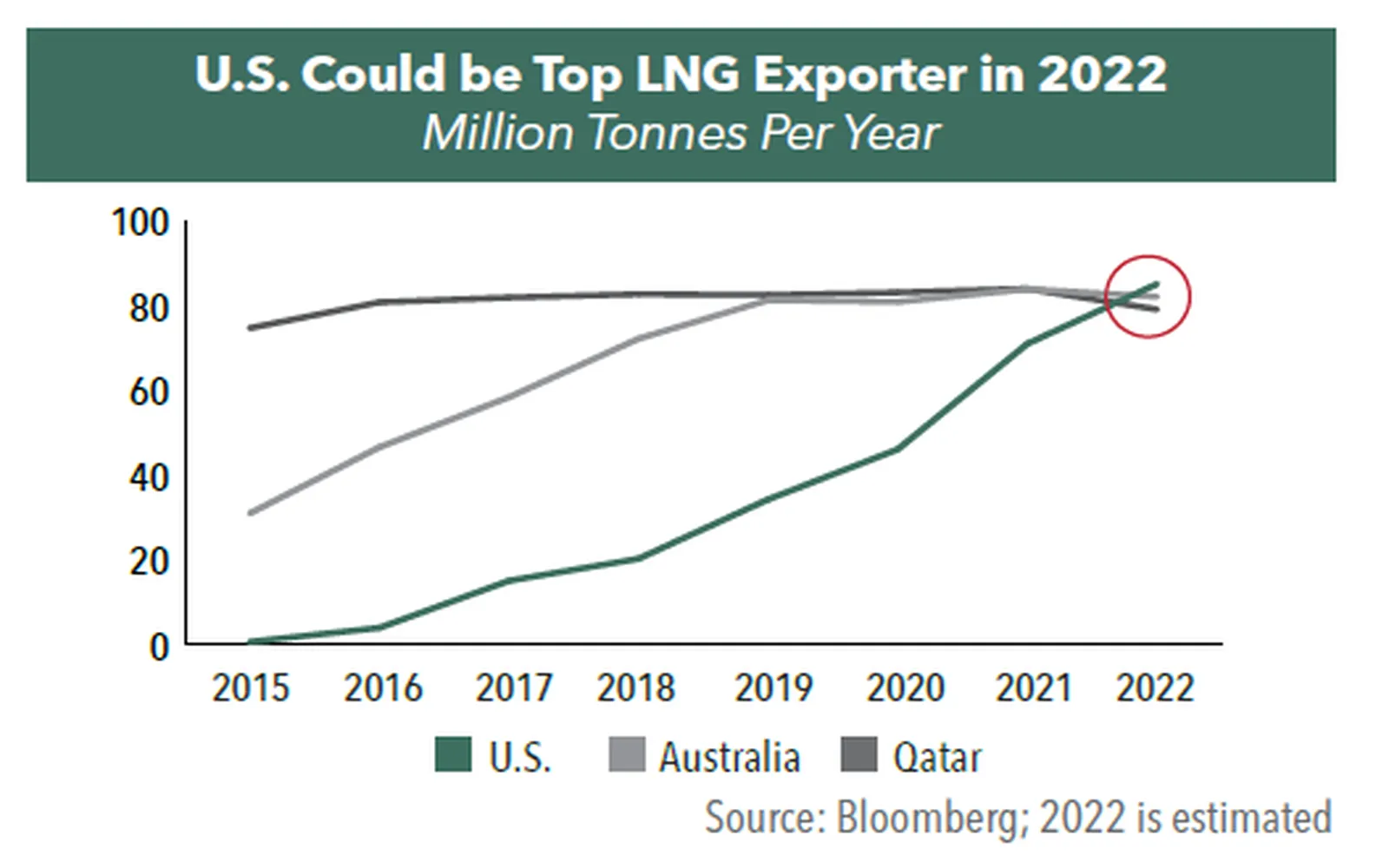

5. Natural Gas

Natural gas has become increasingly important due to its role in energy production and heating. Like crude oil, natural gas prices can be volatile, making it a potential high-reward investment. Investors can gain exposure through futures contracts or ETFs.

Investment Strategies for Commodities

When investing in commodities, it's essential to adopt the right strategies to maximize returns and minimize risks. Here are some effective approaches:

- Physical Ownership: Buying physical commodities like gold or silver gives you tangible assets, but consider storage and insurance costs.

- Exchange-Traded Funds (ETFs): ETFs provide an easy way to invest in a basket of commodities without having to manage physical assets.

- Futures Contracts: Futures allow you to buy or sell a commodity at a predetermined price in the future, but they require a solid understanding of the market.

- Commodity Stocks: Investing in companies that produce commodities can offer exposure while also providing dividends.

Chart: Historical Performance of Key Commodities

The following chart illustrates the historical performance of key commodities over the past decade, highlighting their returns compared to the S&P 500:

| Commodity | Annualized Return (2013-2023) |

|---|---|

| Gold | 6.5% |

| Silver | 5.2% |

| Crude Oil | 7.8% |

| Natural Gas | 4.4% |

| Corn | 3.9% |

Risks of Commodity Investments

While commodities can enhance portfolio diversification, they also come with their own set of risks:

- Volatility: Commodity prices can experience significant fluctuations based on market conditions, weather events, and geopolitical tensions.

- Storage Costs: For physical commodities, storage and insurance can add to overall costs.

- Market Knowledge: A deep understanding of the commodity markets is crucial for successful investing.

Conclusion

Incorporating commodities into your investment portfolio can enhance diversification and provide protection against inflation. By carefully choosing from options like gold, silver, crude oil, agricultural products, and natural gas, you can create a balanced portfolio that can withstand economic fluctuations. Remember to consider both the potential rewards and risks associated with commodity investments to make informed decisions that align with your financial goals.