Investing can be an effective way to grow your wealth, but it can also lead to significant tax liabilities. If you want to maximize your returns, it’s essential to adopt smart strategies to reduce your investment taxes. Here are some effective methods that can help you keep more of your hard-earned money.

1. Utilize Tax-Advantaged Accounts

One of the most effective ways to reduce your investment taxes is by using tax-advantaged accounts. Accounts such as Individual Retirement Accounts (IRAs) and 401(k)s allow you to invest money without immediately incurring taxes on the gains. Traditional IRAs and 401(k)s offer tax deductions on contributions, while Roth IRAs allow for tax-free growth and tax-free withdrawals in retirement.

By maximizing contributions to these accounts, you not only reduce your taxable income but also allow your investments to grow without the burden of annual taxation. Be sure to consult IRS guidelines for contribution limits.

2. Implement Tax-Loss Harvesting

Tax-loss harvesting is a strategy where you sell investments that have lost value to offset the gains from investments that have appreciated. This can help lower your overall tax liability. For example, if you sell an investment for a loss of $5,000 and another for a gain of $10,000, you can offset the gain by the loss, resulting in a taxable gain of $5,000 instead of $10,000.

Keep in mind that the IRS has specific rules regarding wash sales, where you cannot buy the same or substantially identical security within 30 days of selling it at a loss. Understanding these rules is crucial to effectively employing this strategy.

3. Hold Investments for the Long Term

Another strategy to reduce your investment taxes is to hold onto your investments for the long term. In the U.S., investments held for over one year are subject to long-term capital gains tax, which typically has lower rates than short-term capital gains tax. Short-term gains, on the other hand, are taxed at your ordinary income tax rate, which can be significantly higher.

For example, the long-term capital gains tax rates can be 0%, 15%, or 20% depending on your income bracket, while short-term gains are taxed at rates as high as 37%. By holding your investments longer, you can take advantage of these lower rates.

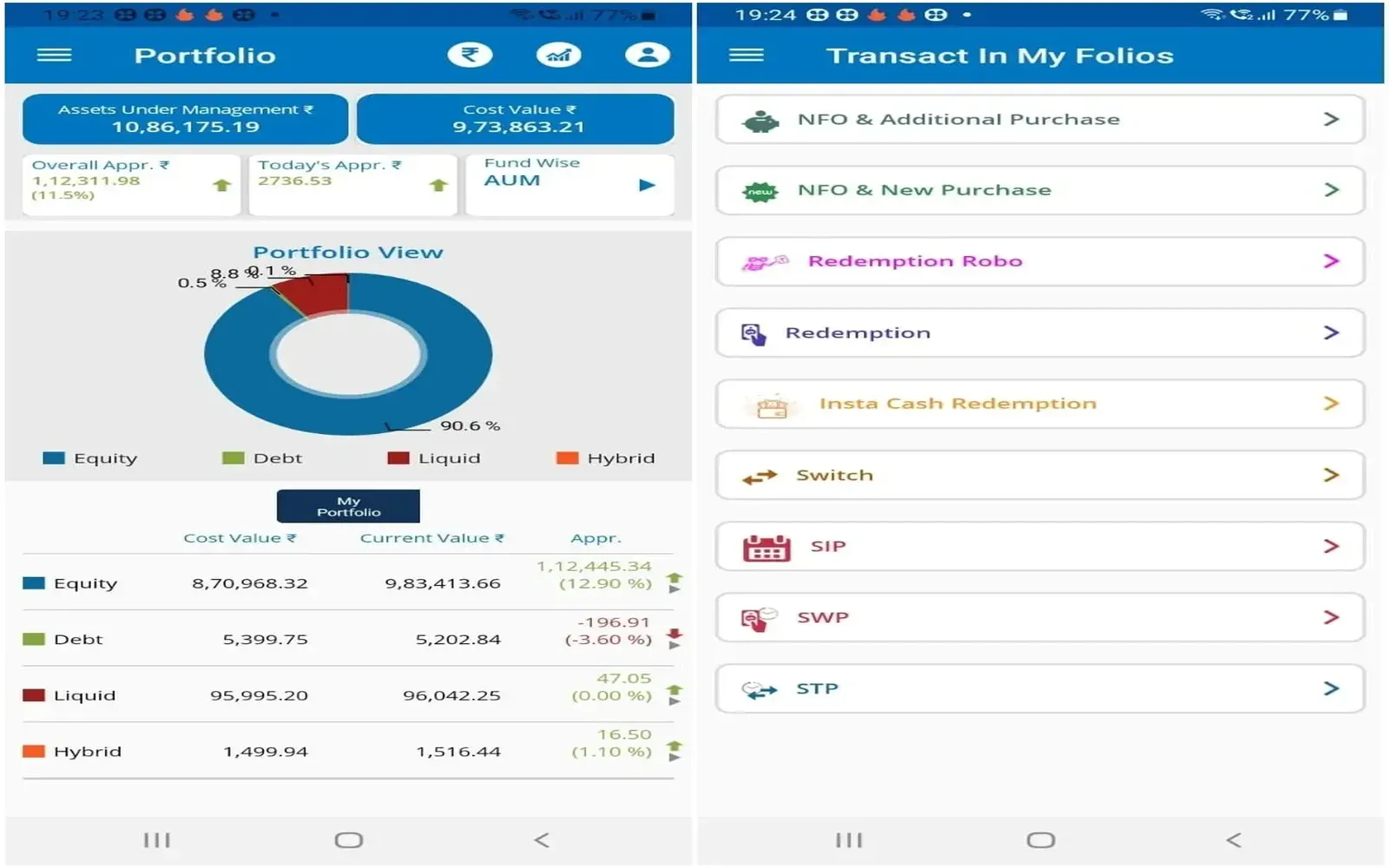

4. Consider Tax-Efficient Investments

Investing in tax-efficient funds can also help minimize your tax liability. Index funds and exchange-traded funds (ETFs) tend to have lower turnover rates compared to actively managed funds, which results in fewer taxable events. Additionally, municipal bonds can provide tax-free interest income, making them an attractive option for investors in higher tax brackets.

Here’s a quick comparison of different investment vehicles and their tax implications:

| Investment Type | Tax Treatment |

|---|---|

| Stocks (held long-term) | Long-term capital gains tax |

| Stocks (held short-term) | Ordinary income tax rate |

| Mutual Funds | Distributions taxed as ordinary income or capital gains |

| ETFs | More tax-efficient than mutual funds |

| Municipal Bonds | Tax-free at the federal level |

5. Take Advantage of Deductions and Credits

Make sure to leverage any available tax deductions and credits related to your investments. For example, investment interest expenses may be deductible if you itemize your deductions. Additionally, you might qualify for certain tax credits that can reduce your overall tax liability.

Always review your individual circumstances and consult with a tax professional to ensure you are taking advantage of all possible deductions and credits.

6. Plan Your Withdrawals Wisely

When it comes to withdrawals from your investment accounts, timing can have a significant impact on your tax liability. For example, withdrawing funds from a traditional IRA or 401(k) can push you into a higher tax bracket. Planning your withdrawals strategically can help minimize the tax impact. Consider spreading withdrawals over several years to stay in a lower tax bracket.

Additionally, if you have both taxable and tax-advantaged accounts, consider withdrawing from the taxable accounts first when you need cash. This can allow your tax-advantaged accounts to continue to grow tax-free for a longer period.

7. Consult a Tax Professional

Finally, consulting with a tax professional is one of the smartest strategies for reducing your investment taxes. A tax advisor can provide personalized advice based on your financial situation, helping you navigate complex tax laws and ensure you are maximizing your tax-saving strategies.

By implementing these smart strategies to reduce your investment taxes, you can increase your overall returns and retain more of your wealth. Whether you are just starting out or are an experienced investor, understanding and applying these techniques is essential for financial success.