When it comes to securing your home, finding the best home insurance quote is essential. With various providers and policy options available, it can be overwhelming to navigate the process. However, understanding how to obtain the best quote tailored to your specific needs can make all the difference. In this article, we will outline steps you can take to ensure you get the most suitable coverage for your situation.

Understand Your Coverage Needs

Before seeking quotes, it’s crucial to assess the level of coverage you require. Consider the following factors:

- Replacement Cost vs. Actual Cash Value: Replacement cost covers the expense to rebuild your home with similar materials, while actual cash value takes depreciation into account.

- Personal Property Coverage: Estimate the value of your belongings to determine how much coverage you need.

- Liability Coverage: Decide how much liability coverage is necessary to protect against potential lawsuits.

- Additional Living Expenses (ALE): This provides coverage for temporary housing if your home becomes uninhabitable.

Gather Necessary Information

To receive accurate quotes, you will need to provide various details about your home and personal situation. This includes:

- Home Value: Know the market value of your property.

- Home Features: Include details about the age, size, and condition of your home.

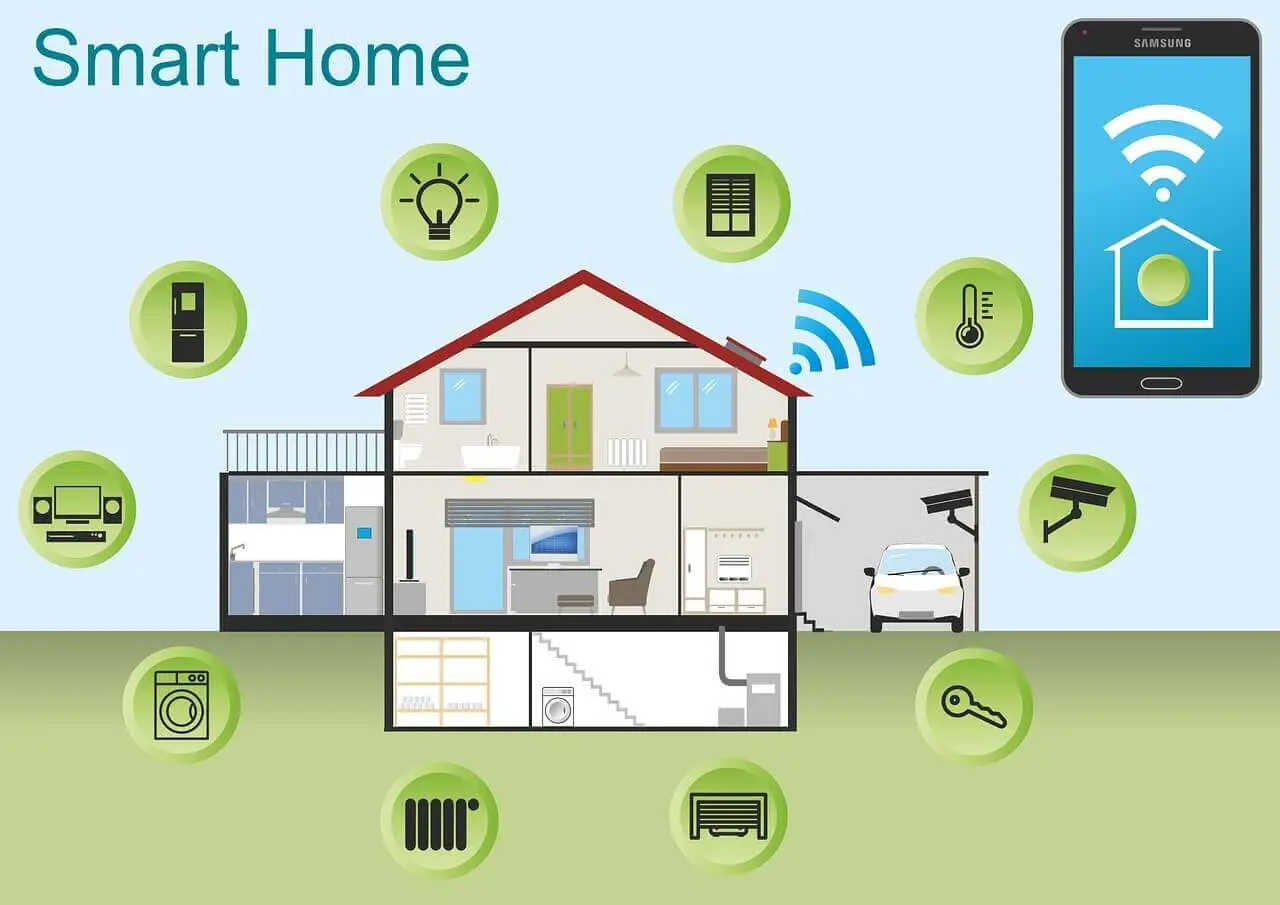

- Security Features: Mention any security systems or safety features, as these can lower your premium.

- Claims History: Be prepared to discuss any previous claims you have made.

Shop Around for Quotes

Once you have a clear understanding of your coverage needs and have collected the necessary information, it’s time to start shopping for quotes. Here’s how to do it effectively:

- Contact Multiple Insurers: Reach out to at least three to five insurance companies to compare their quotes.

- Use Online Comparison Tools: Websites like Policygenius and The Zebra allow you to compare multiple quotes simultaneously.

- Work with an Insurance Agent: An independent agent can help you understand your options and find the best deals.

Understanding Your Quotes

When you receive quotes, it's essential to analyze them carefully. Here’s a breakdown of what to look for:

- Premiums: The amount you’ll pay for your policy; lower premiums might come with higher deductibles.

- Deductibles: The amount you’ll pay out of pocket before your insurance kicks in. Higher deductibles usually result in lower premiums.

- Policy Limits: Ensure that the limits on your coverage are adequate for your needs.

- Exclusions: Review what is not covered in your policy to avoid surprises during claims.

Consider Discounts

Many insurance companies offer discounts that can significantly reduce your premium. Ask about the following:

- Bundling Discounts: If you bundle your home insurance with auto or other types of insurance, you may qualify for a discount.

- Claims-Free Discounts: If you have a history of not filing claims, some companies reward you with lower rates.

- Safety Feature Discounts: Installing smoke detectors, security systems, or other safety features can lead to premium reductions.

Chart: Average Home Insurance Costs by State

| State | Average Annual Premium |

|---|---|

| California | $1,000 |

| Texas | $1,800 |

| Florida | $2,000 |

| New York | $1,200 |

| Illinois | $1,100 |

Review and Adjust Annually

Once you have chosen a policy, it is essential to review your coverage annually. Life changes, such as renovations or major purchases, may require adjustments to your coverage. Regularly comparing quotes can also ensure you continue to receive the best rates available.

Final Thoughts

Finding the best home insurance quote requires careful consideration of your needs and diligent research. By understanding your coverage requirements, gathering necessary information, shopping around, and taking advantage of discounts, you can secure a policy that not only fits your budget but also provides the protection you need. Don't forget to review your coverage regularly to adapt to any changes in your life or property.