When it comes to protecting your assets, securing the best rates on auto insurance and home insurance is crucial. In the United States, insurance costs can vary significantly based on several factors. Below are strategies you can implement to ensure you are getting the best coverage at the most affordable rates.

Understand the Factors Affecting Insurance Rates

Before you start looking for the best rates, it’s essential to understand what influences insurance premiums. The following factors can significantly affect how much you pay:

- Driving History: A clean driving record with no accidents or violations can lead to lower auto insurance rates.

- Credit Score: Many insurance companies use credit scores to assess risk. A higher score often translates into lower premiums.

- Location: Where you live can affect your insurance rates. Urban areas typically have higher premiums due to increased risks.

- Type of Vehicle: The make and model of your car can impact your auto insurance rates. Luxury and sports cars usually cost more to insure.

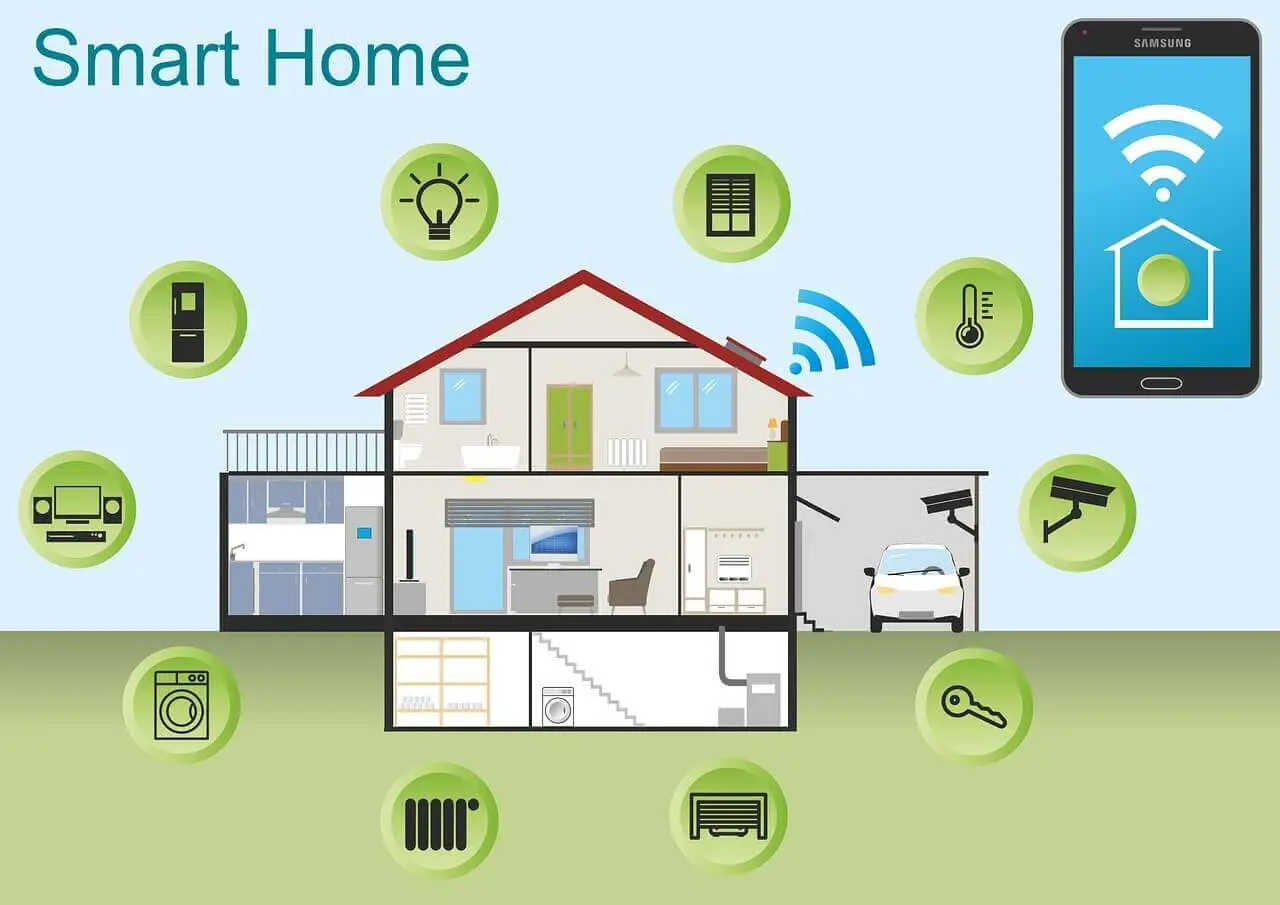

- Home Characteristics: The age, condition, and security features of your home can affect your home insurance rates.

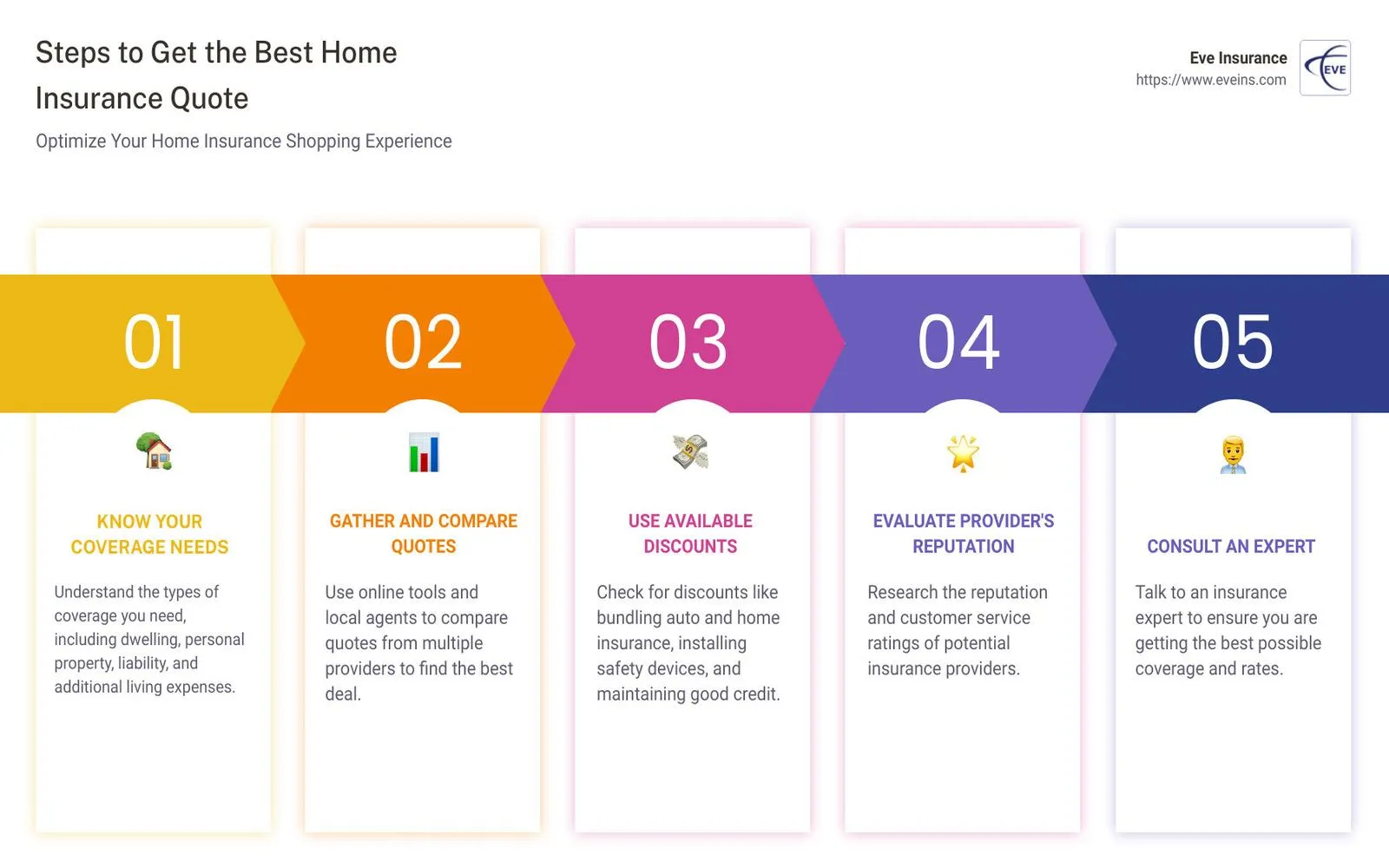

Shop Around for Quotes

One of the best ways to find the best rates on auto and home insurance is to shop around. Different insurance companies offer various rates and coverage options. Here’s how to effectively compare quotes:

- Request quotes from at least three to five different insurance providers.

- Ensure you are comparing the same coverage levels. Look for similar deductibles and policy limits.

- Consider using online comparison tools to make the process easier.

Bundle Your Policies

Many insurance companies offer discounts for bundling multiple policies. By combining your home insurance and auto insurance with the same provider, you could save a significant amount on your premiums. Typically, bundling can save you anywhere from 5% to 25% on your overall policy costs.

Utilize Discounts

Insurance companies offer a variety of discounts that can help lower your premiums. Here are some common ones:

- Safe Driver Discounts: If you have a clean driving record, you may qualify for discounts.

- Multi-Policy Discounts: As mentioned earlier, bundling policies can lead to significant savings.

- Home Security Discounts: Installing security systems or smoke detectors can lower your home insurance rates.

- Low Mileage Discounts: If you don’t drive much, some auto insurance companies will offer reduced rates.

Review Your Coverage Regularly

Your insurance needs may change over time, and so should your coverage. Regularly reviewing your policies ensures that you are not over-insured or under-insured. Here’s what to consider during your review:

- Changes in your driving habits or vehicle.

- Renovations or changes to your home that could affect its value.

- Life changes such as marriage, having children, or retirement.

Increase Your Deductible

Another effective way to reduce your premiums is to increase your deductibles. A higher deductible means you will pay more out-of-pocket in the event of a claim, but it can significantly lower your monthly premiums. Just be sure you can afford the deductible in case of an accident or loss.

Consider Usage-Based Insurance

Some auto insurance companies offer usage-based insurance programs that track your driving habits. If you are a safe driver, you could receive substantial discounts. These programs often use telematics devices or mobile apps to monitor your driving behavior.

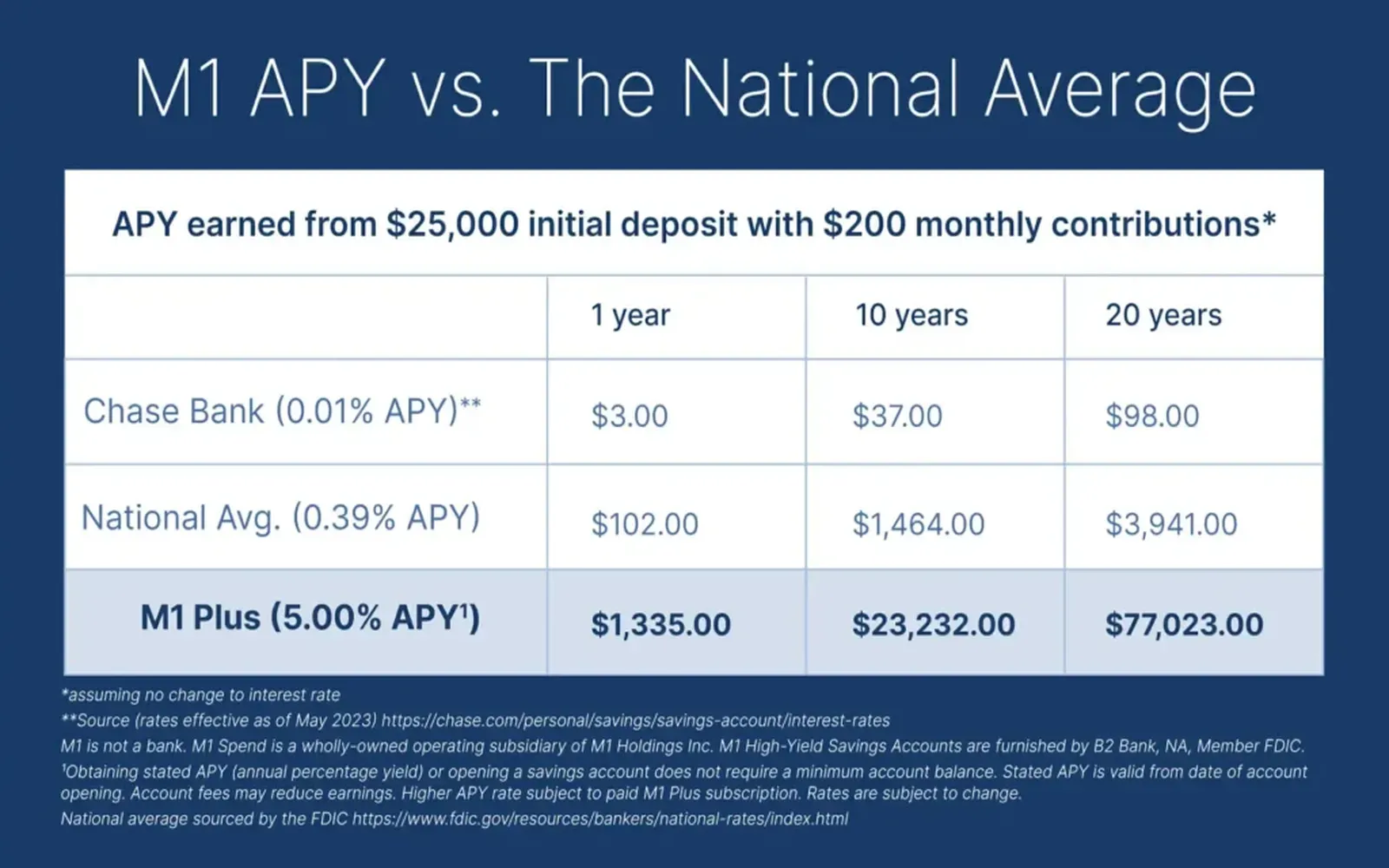

Chart: Average Insurance Rates in the U.S.

To give you a better idea of what to expect in terms of insurance rates, here is a chart summarizing average costs in the United States:

| Insurance Type | Average Annual Premium |

|---|---|

| Auto Insurance | $1,500 |

| Home Insurance | $1,200 |

| Bundled Auto & Home Insurance | $2,500 |

Final Thoughts

Getting the best rates on auto and home insurance requires time and effort, but the savings can be substantial. By understanding the factors influencing your premiums, shopping around, bundling policies, and taking advantage of discounts, you can secure the best possible rates. Regularly reviewing your policies and considering higher deductibles can also lead to significant savings. Protecting your assets doesn’t have to break the bank—start implementing these strategies today!