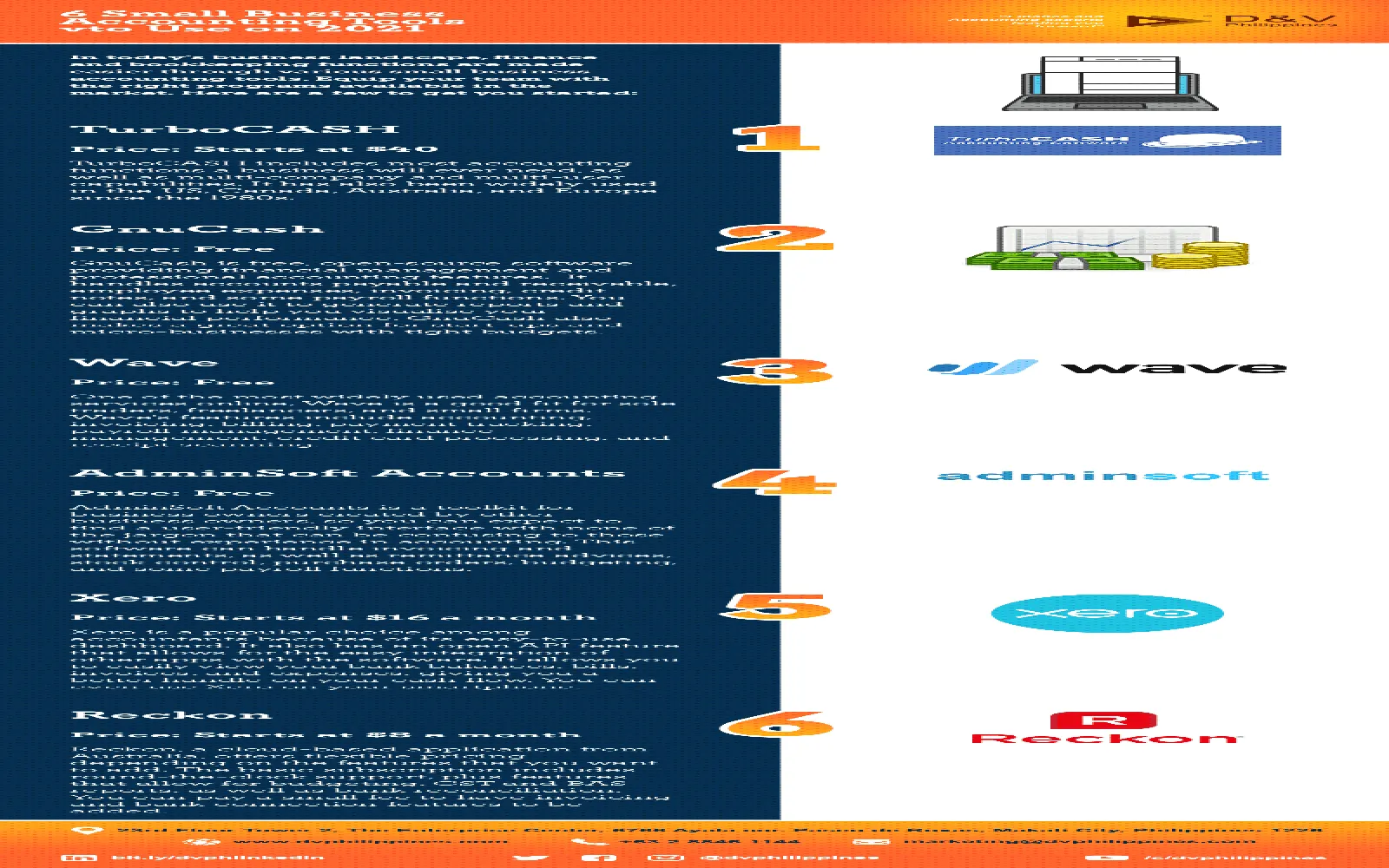

Understanding the Importance of Accounting Tools

In today's fast-paced business environment, keeping your financial records organized is crucial for success. With the right accounting tools, you can simplify your bookkeeping, enhance accuracy, and make informed financial decisions. From small businesses to large enterprises, utilizing effective accounting software can save time, reduce costs, and streamline operations. In this article, we will explore the top accounting tools that can help you manage your books efficiently.

1. QuickBooks Online

QuickBooks Online is one of the most popular accounting solutions available, particularly for small to medium-sized businesses. Its cloud-based platform allows you to access your financial data anytime, anywhere. Key features include:

- Automated invoicing and payment reminders

- Expense tracking and reporting

- Integration with banking systems

- Multi-user access for team collaboration

QuickBooks Online offers various pricing plans, making it suitable for businesses of all sizes. Its user-friendly interface and extensive resources help users navigate the software with ease.

2. Xero

Xero is another cloud-based accounting software that has gained traction among small business owners. Known for its intuitive design, Xero offers numerous features, including:

- Real-time collaboration with your accountant

- Comprehensive financial reporting

- Mobile app for on-the-go access

- Integration with over 800 business apps

With Xero, you can also automate tasks such as invoicing and bank reconciliation, which can significantly reduce the time spent on bookkeeping.

3. FreshBooks

FreshBooks is particularly favored by freelancers and service-based businesses due to its user-friendly interface and strong invoicing capabilities. Key features include:

- Customizable invoices with branding options

- Time tracking for billable hours

- Expense management

- Client relationship management tools

FreshBooks also offers excellent customer support, making it easy to get assistance when needed. Its pricing plans cater to different business sizes, ensuring that you only pay for what you need.

4. Wave Accounting

If you're looking for a free accounting solution, Wave Accounting is an excellent choice. It provides a range of features that can help you manage your finances without any cost. Key features include:

- Unlimited invoicing and expense tracking

- Integrated payment processing

- Financial reporting tools

- Receipt scanning capabilities

While Wave is free to use, it does charge fees for payment processing and payroll services. This makes it a great option for startups and freelancers who want to keep their costs low.

5. Zoho Books

Zoho Books is an all-in-one accounting software that offers robust features for small businesses. It’s particularly known for its automation capabilities. Key features include:

- Automated workflows for recurring invoices

- Inventory management

- Multi-currency support

- Project management tools

Zoho Books integrates seamlessly with other Zoho applications, allowing for a more comprehensive business management experience. The pricing is competitive, making it an attractive option for growing businesses.

Comparison Chart of Top Accounting Tools

| Accounting Tool | Key Features | Starting Price |

|---|---|---|

| QuickBooks Online | Automated invoicing, expense tracking, multi-user access | $25/month |

| Xero | Real-time collaboration, financial reporting, mobile app | $12/month |

| FreshBooks | Customizable invoices, time tracking, expense management | $15/month |

| Wave Accounting | Unlimited invoicing, financial reporting, receipt scanning | Free |

| Zoho Books | Automated workflows, inventory management, project tools | $15/month |

6. Conclusion

Choosing the right accounting tools can significantly impact your business's financial health. Each of the options listed above offers unique features tailored to different business needs. Whether you prefer a comprehensive solution like QuickBooks Online or a free option like Wave Accounting, the key is to select a tool that aligns with your specific requirements. By leveraging these tools, you can simplify your bookkeeping, enhance productivity, and focus on what truly matters—growing your business.